1. Painful start to the quarter: US markets are off to a disastrous start in the second quarter amid concerns over trade and President Donald Trump's attacks on Amazon.

The Dow Jones industrial average shed 1.9% on Monday. The S&P 500 dropped 2.2% and the Nasdaq plunged 2.7%.

Investors are worried about the possibility of a trade war between the United States and China, and they were unsettled by Beijing's announcement of new tariffs on US goods.

Meanwhile, tweets from Trump hit tech stocks. The president accused Amazon of taking advantage of the US Postal Service, causing the online retailer's stock to drop 5%.

Tesla (TSLA), Netflix (NFLX) and Cisco (CSCO) all dropped by at least 4%.

The VIX volatility index jumped more than 15% on Monday and CNNMoney's Fear & Greed Index dropped further into "extreme fear" territory.

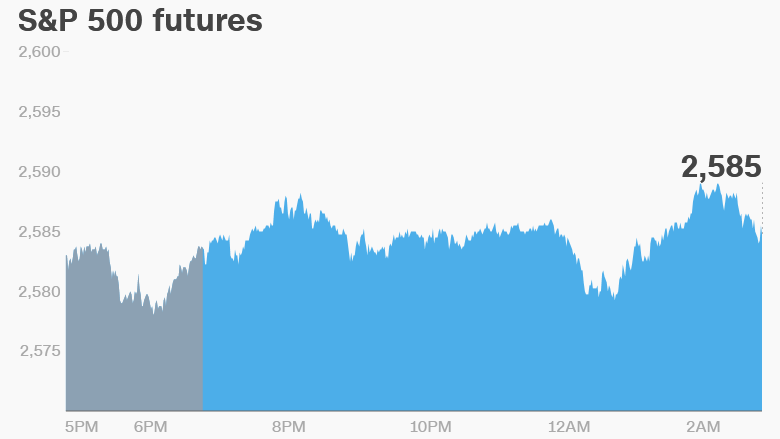

2. Global market overview: US stock futures were pointing higher on Tuesday.

Major indexes in Asia fell more than 1% on Tuesday morning before recovering much of their losses later in the day. European stock markets dipped, with some major indexes down by 1% to 2% as trading resumed after the holiday.

3. Spotify IPO: Spotify (SPOT) is expected to go public on Tuesday in an unusual IPO process that has analysts effectively throwing up their hands about what to expect.

Unlike traditional IPOs, Spotify will not raise new capital. Instead it will simply list existing shares directly on the New York Stock Exchange without relying on underwriters to help assess demand and set a price.

It will trade under the ticker SPOT.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

4. Fox ups its Sky guarantees: Rupert Murdoch's 21st Century Fox is making a new pitch to win approval for its planned takeover of British broadcaster Sky.

The UK Competitions and Markets Authority published two new proposals from 21st Century Fox on Tuesday that are designed to address the regulator's concerns that the purchase would give the Murdoch family too much control over UK media.

The first proposal would see 21st Century Fox selling Sky (SKYAY) news business to Disney (DIS).

According to 21st Century Fox (FOXA), Disney wants to get its hands on Sky News whether or not its planned $52 billion purchase of a big chunk of 21st Century Fox is successful.

Under the second proposal, Sky News would be legally separated from the rest of Sky in a bid to ensure its editorial independence.

5. Earnings and economics: Dave & Buster's (PLAY) will release its earnings after the US close.

Auto sales data will be published by the Commerce Department at 2 p.m. ET.

Markets Now newsletter: Get a global markets snapshot in your inbox every afternoon. Sign up now!

6. Coming this week:

Tuesday — Spotify IPO expected

Wednesday — ADP National Employment Report

Thursday — February trade deficit report

Friday — Jobs report