1. China steps up trade fight: China has slapped a huge charge on American imports of sorghum, accusing the United States of dumping the crop on its markets.

From Wednesday, Chinese customs officers will charge importers a fee of about 179% on US shipments of the crop after an investigation found they were being unfairly subsidized and damaging Chinese producers.

Sorghum is used to feed livestock and make a liquor that's very popular with Chinese drinkers. China is the largest buyer of American sorghum products. It imported about $960 million worth last year, according to Chinese data.

Broader trade tensions remain high: The United States cracked down on one of China's biggest tech companies, ZTE (ZTCOF), on Monday. It banned the smartphone maker from buying components from American firms.

2. Testing times for Tesla: Tesla announced Monday it had temporarily suspended production of its Model 3.

Tesla (TSLA) said that it's pressing pause in order "to improve automation" and deal with bottlenecks. The company declined to say how long the stoppage would last.

Tesla's stock has been battered by worries that it's behind on production of the Model 3. The sedan is an attempt by the company to shift from producing small numbers of luxury vehicles to making cars on a much larger scale.

3. Blockbuster bank earnings: Goldman Sachs (GS) is set to report its earnings before the opening bell on Tuesday. Investors are hoping it will follow the trend set by its rivals and top analysts' forecasts.

It's been a strong earning season for the banks so far. Bank of America (BAC) reported its highest profits in history on Monday, taking out the previous record set in 2011. JPMorgan Chase (JPM), the largest US bank, posted a 35% jump in earnings on Friday. Citigroup (C) and Wells Fargo (WFC) also beat forecasts.

The strong earnings are at least partly because of President Donald Trump's tax cuts. The banks also benefited from recent market volatility as clients rushed to execute buy and sell trading orders. And the strong economy in the United States and abroad is adding to the momentum.

4. China powers ahead: China's economy grew 6.8% in the first quarter of 2018, according to government data published Tuesday.

China's government said last month that it's aiming for economic growth of around 6.5% for the full year, lower than the 6.9% that it reported for 2017.

There will be more news on the global economy when the International Monetary Fund publishes its latest World Economic Outlook at 9 a.m. ET.

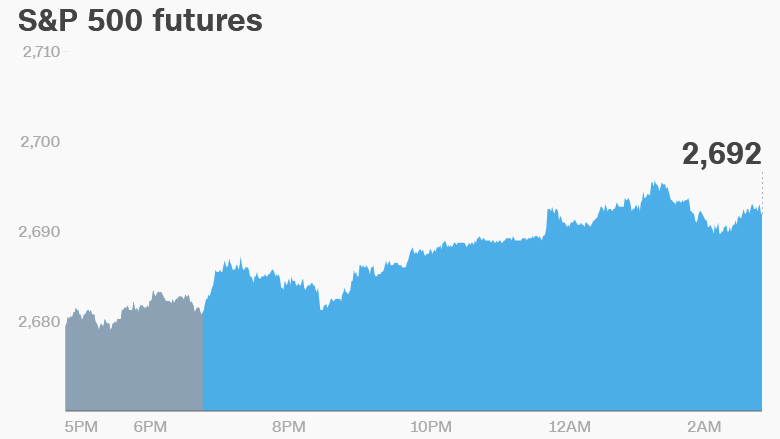

5. Global market overview: US stock futures were pointing up early on Tuesday.

European markets were mostly higher, while markets in Asia ended the session mixed.

The Dow Jones industrial average closed 0.9% higher on Monday, while the S&P 500 added 0.8% and the Nasdaq gained 0.7%.

Walgreen (WBA) and other pharmacy stocks jumped on Monday on reports that Amazon (AMZN) is backing away from selling prescription drugs.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

6. Earnings and economics: Johnson & Johnson (JNJ) and UnitedHealth (UNH) are set to report their earnings before the opening bell on Tuesday. IBM (IBM) and United Continental (UAL), the owner of United Airlines, will follow after the close.

Netflix (NFLX) jumped 6% in premarket trading after the company reported stronger than expected subscriber numbers.

The latest US housing markets statistics will be released by the Census Bureau at 8:30 a.m. ET.

Unemployment in the United Kingdom dropped to 4.2% in the three months to February, the lowest since 1975.

Markets Now newsletter: Get a global markets snapshot in your inbox every afternoon. Sign up now!

7. Coming this week:

Tuesday — Goldman Sachs, United (UAL) earnings

Wednesday — Morgan Stanley, American Express (AXP) earnings

Thursday — BNY Mellon earnings

Friday — State Street (STT), Procter & Gamble (PG), GE earnings