1. GE earnings: General Electric (GE) is reporting earnings before the opening bell on Friday.

GE's stock has plunged 18% since its last earnings report on January 24, reflecting the company's deep financial and legal woes.

It is planning to sell $20 billion worth of businesses. CEO John Flannery has signaled he is willing to go further by breaking up GE's vast empire, which includes everything from MRI machines to jet engines.

2. Banking fines: Wells Fargo (WFC) is facing a $1 billion fine for forcing customers into car insurance and charging mortgage borrowers unfair fees.

The fine will be announced as early as Friday by the Consumer Financial Protection Bureau and the Office of the Comptroller of the Currency, according to a person familiar with the enforcement action.

Shares in Wells Fargo slid in premarket trading.

Barclays (BCS) CEO Jes Staley has survived a UK investigation into his attempt to identify a whistleblower at the bank, but the American boss will have to pay a fine.

3. Pound takes a hit: The British pound has fallen sharply after Bank of England Governor Mark Carney cast doubt on the timing of the next hike in interest rates raise in the United Kingdom.

Economists were expecting a rise in May, but Carney told the BBC late Thursday that the timing was not set in stone, given recent mixed economic data and uncertainty about Brexit.

The pound dropped 0.8% against the dollar and slid again early on Friday to trade at $1.40. That is a sharp reversal from earlier this week, when it touched $1.43, the highest level since the Brexit referendum in June 2016.

4. Pharma frenzy subsides: Allergan (AGN) said it had decided not to join a bidding war for biotech firm Shire, the latest twist in a takeover tussle that has sent Shire (SHPG) stock surging. Allergan's shares climbed in premarket trading.

Japan's Takeda (TKPHF) said Thursday it had considered paying about £42.4 billion ($60 billion) for Shire, but that its proposal had been rebuffed. Takeda said it would continue talking to Shire about a possible bid.

Shire gained as much as 12% on Thursday, but dropped 3.5% on Friday.

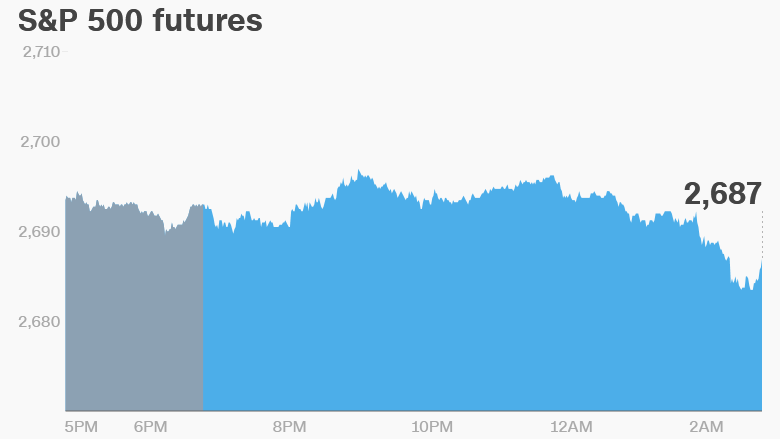

5. Global market overview: US stock futures were pointing lower early on Friday.

European markets opened mixed, while markets in Asia finished the session lower.

The Dow Jones industrial average closed 0.3% lower on Thursday, while the S&P 500 fell 0.6% and the Nasdaq shed 0.8%.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

6. Companies and economics: Baker Hughes (BHGE), Honeywell (HON) and State Street (STT) are set to report earnings before the opening bell.

Chinese tech company ZTE (ZTCOF), which sells smartphones and other telecommunications equipment around the world, hit back at the US government's decision to ban it from buying components from American companies.

ZTE said the move was "extremely unfair" and that the company "cannot accept it." Its shares, which trade in Hong Kong and Shenzhen, have been suspended since the Commerce Department announced the ban Monday.

Canadian inflation data will be released at 8:30 a.m. ET on Friday. Eurozone consumer confidence report will follow at 10 a.m. ET.

Markets Now newsletter: Get a global markets snapshot in your inbox every afternoon. Sign up now!

7. Coming this week:

Friday — State Street (STT) and GE earnings