1. Amazon on fire: Shares in Amazon jumped more than 7% in extended trading after its earnings report wowed investors.

Amazon (AMZN) made $1.6 billion in profit during the first three months of 2018, more than double the same period a year earlier. The gains came even as it invests in costly fulfillment centers and original video programming.

Analysts had expected profit to slip compared to last year.

The performance was driven by Amazon's cloud computing business, Amazon Web Services, and a fast-growing advertising division that is now a multi-billion dollar business.

2. Korea summit: Stocks in Asia posted modest gains as the leaders of North and South Korea met for the first time in more than a decade.

Kim Jong Un became the first North Korean leader to cross the demilitarized zone into South Korea since fighting ended in the Korean War. He shook South Korean President Moon Jae-in's hand on both sides of the demarcation line.

The two spoke about denuclearizing the Korean Peninsula, improving relations and seeking a formal peace settlement.

3. Oil giants in focus: Exxon Mobil (XOM) and Chevron (CVX) are set to report their earnings before the opening bell.

Both companies announced a surprise dividend rise on Thursday.

Exxon's stock has gained 9.7% in the past month, while Chevron is up 8.3%. However, investors will be cautious after both companies missed their earnings in the last quarter.

Phillips 66 (PSX) is also reporting on Friday.

US crude oil futures have soared 12.5% this year. They were trading 0.3% lower early on Friday at $68 per barrel.

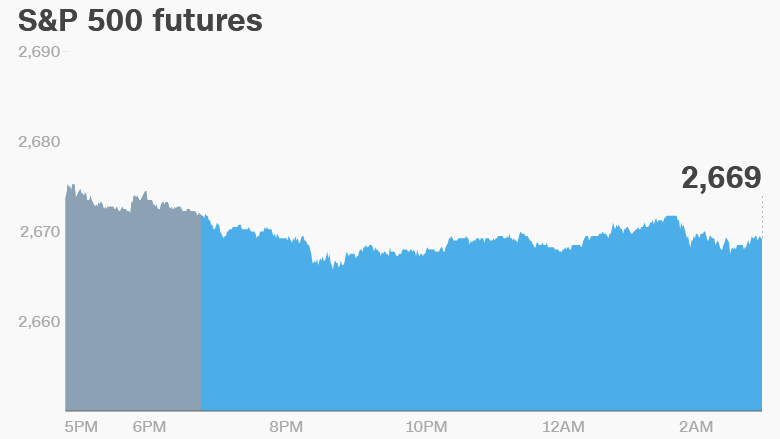

4. Global market overview: US stock futures were mixed. European markets opened mostly higher.

The Dow Jones industrial average and the S&P 500 both closed 1% higher on Thursday, while the Nasdaq surged 1.6%.

Facebook (FB) jumped 9% on Thursday, notching its best day in more than two years, after reporting earnings. Chipotle (CMG) soared 24% after reporting results that were much better than expected.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

5. Earnings and economics: The British economy stalled in the first quarter of 2018, expanding by just 0.1% over the previous quarter.

That was much weaker growth than economists were expecting (0.3%) and represents a sharp slowdown from the final quarter of 2017. It's also the weakest quarterly GDP data in more than 5 years.

The pound slumped in response, falling 0.7% against the US dollar, as the weak data undermines the case for another rise in UK interest rates anytime soon.

In France, economic growth slowed to 0.3% in the first quarter. Spain's economy expanded by 0.7% over the same period.

The US Bureau of Economic Analysis will release first quarter GDP data at 8:30 a.m. ET.

Markets Now newsletter: Get a global markets snapshot in your inbox every afternoon. Sign up now!

6. Coming this week:

Friday — Exxon, Chevron Corp results; Q1 GDP