1. Iran decision: President Donald Trump will announce his decision on whether to scrap the Iran nuclear deal at 2:00 p.m. ET.

Trump is widely expected to stop waiving sanctions on Iran's energy and banking sector that were lifted as part of the 2015 agreement in exchange for curbs on Tehran's nuclear program. US allies have urged Trump to stick with the deal.

Trump's decision could have a major impact on energy markets. Oil prices have surged nearly 13% over the past month to their highest level since 2014 on fears of supply disruptions.

"[The] decision on whether to pull out of the deal to limit sanctions on Iran in return for limits to its nuclear program will hang over markets," said Kit Juckes, a strategist at Societe Generale.

2. Disney earnings: Disney (DIS) will report its quarterly earnings after the closing bell.

The company is likely to boast about the success of "Black Panther," which has made more than $688 million domestically. Its "Avengers: Infinity War" and the upcoming Star Wars movie "Solo" are also expected to be huge hits.

Investors will be looking for updates on Disney's plan to buy most of 21st Century Fox (FOX), which is scheduled to report on Wednesday.

Shares in Fox surged nearly 5% in extended trading after Reuters reported that Comcast (CMCSA) is speaking to investment banks about obtaining financing to potentially crash the Disney-Fox deal.

3. Pharma deal: Japan's Takeda (TKPHF) said it has finalized a deal to buy Dublin-based biotech firm Shire (SHPG) for £46 billion ($64.3 billion).

Shire's board had said that previous takeover bids from Shire had undervalued the company and put its future growth at risk.

Shares in Takeda gained 4% in Tokyo, while Shire stock was up 3.6% in London.

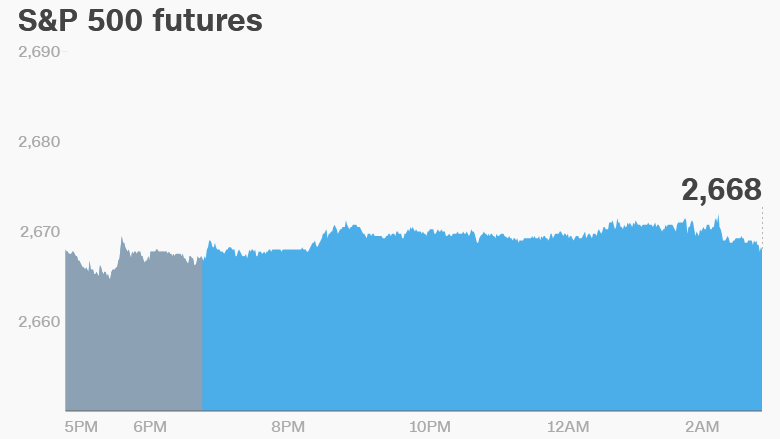

4. Global market overview: US stock futures were flat.

European markets opened mixed, following a mostly positive trading session in Asia.

The Dow Jones industrial average and the S&P 500 both gained 0.4% on Monday. The Nasdaq added 0.8%.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

5. Earnings and economics: Dean Foods (DF), Discovery (DISCA), DISH Network (DISH), Gray Television (GTN), Moneygram (MGI), SeaWorld Entertainment (SEAS) and TEGNA (TGNA) will release earnings before the open.

Bojangles' (BOJA), Electronic Arts (EA), Etsy (ETSY), Fossil (FOSL), GoDaddy (GDDY), La Quinta Holdings (LQ), Marriott (MAR), Papa John's (PZZA), Potbelly (PBPB), Sturm Ruger (RGR), TripAdvisor (TRIP), Walt Disney (DIS), and Wendy's (WEN) will follow after the close.

The US Labor Department will release its jobs openings report for March at 10:00 a.m. It comes just days after a strong jobs report. The unemployment rate dropped to 3.9% in April, the first time it's been below 4% since 2000.

Markets Now newsletter: Get a global markets snapshot in your inbox every afternoon. Sign up now!

6. Coming this week:

Tuesday — Disney, Sturm Ruger (RGR) earnings; JOLTS

Wednesday — 21st Century Fox earnings; PPI

Thursday — CPI

Friday — University of Michigan's Consumer Sentiment survey