1. Iran deal fallout: Oil prices have surged after President Donald Trump said the United States would exit the Iran nuclear deal.

US crude futures jumped 3% on Wednesday to trade at $71 per barrel, their highest level since late 2014.

Trump said Tuesday that the United States would begin reinstating sanctions on Iran, raising fears of disruption in the oil market.

Iran ramped up production by about 1 million barrels a day after sanctions were eased in 2016. Some of that oil could now be pulled from the market — at a time when oil prices are already rising because of production cuts by OPEC and Russia as well as instability in Venezuela.

WATCH: 'Markets Now' with BlackRock chief equity strategist Kate Moore at 12:45 p.m. ET

2. Vodafone-Liberty deal: American media mogul John Malone is selling a big chunk of his cable and broadband empire to UK telecoms operator Vodafone (VOD) for close to €10.6 billion ($13 billion).

Vodafone is buying operations in Germany, the Czech Republic, Hungary and Romania from Malone's Liberty Global (LBTYA).

Vodafone CEO Vittorio Colao said the acquisition will make the company "Europe's leading next generation network owner, serving the largest number of mobile customers and households across the EU."

Shares in Vodafone jumped 1.8% after the announcement.

Malone's Liberty Media is a minority investor in Time Warner (TWX), the parent company of CNN, according to Liberty Media's website.

3. Fox earnings: 21st Century Fox (FOX) is scheduled to report earnings after the closing bell, and investors will be hoping for more hints on its future.

Fox is mixed up in two complicated bidding wars, both as a buyer and a target.

It is competing with Comcast (CMCSA) to buy the British pay-TV provider Sky (SKYAY). At the same time, Disney (DIS), which is trying to buy most of Fox, is now facing potential rival bid for the assets from Comcast.

Comcast is talking to investment banks about usurping the $52 billion Disney-Fox deal, three sources with knowledge of the matter told CNNMoney's Dylan Byers.

Shares in Comcast dropped 6% on Tuesday.

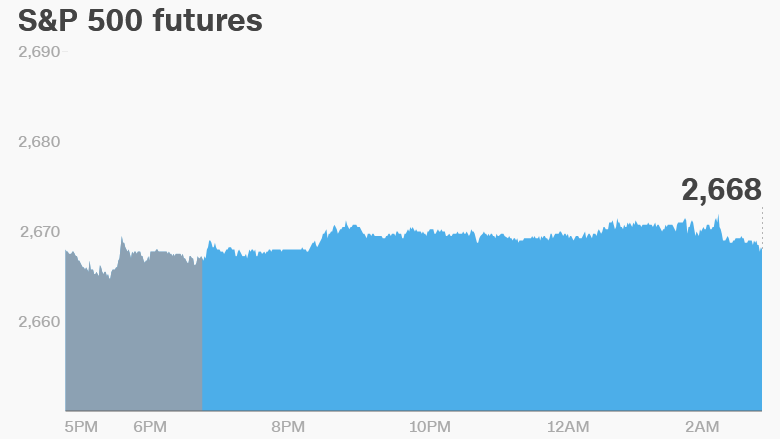

4. Global market overview: US stock futures were higher.

European markets and stocks in Asia struggled to find direction after Trump's bombshell Iran announcement.

The Dow Jones industrial average, the S&P 500 and the Nasdaq closed little changed on Tuesday.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

5. Earnings and economics: Anheuser-Busch InBev (BUD), Cars.com (CARS), Groupon (GRPN), Office Depot (ODP), Party City (PRTY), Sinclair Broadcast (SBGI), and Toyota Motor (TM) will release earnings before the open.

21st Century Fox (FOXA), CenturyLink (CTL), Hostess Brands (TWNK), Roku (ROKU), and Rosetta Stone (RST) will follow after the close.

Shares in TripAdvisor (TRIP) surged as much as 19% in extended trading after it reported better than expected earnings.

The US Bureau of Labor Statistics will publish its producer price index for April at 8:30 a.m. ET.

Markets Now newsletter: Get a global markets snapshot in your inbox every afternoon. Sign up now!

6. Coming this week:

Wednesday — 21st Century Fox earnings; PPI

Thursday — CPI

Friday — University of Michigan's Consumer Sentiment survey