1. Xerox walks away: Xerox (XRX) is pulling out of a multibillion-dollar deal to be taken over by Japan's Fujifilm (FUJIF).

The US printer and copier company announced the move in a statement late Sunday, saying it had reached a new agreement with activist investors Carl Icahn and Darwin Deason, who had bitterly opposed the Fujifilm deal.

The Japanese company said it disagrees with Xerox's "unilateral decision" and doesn't think the US company has the legal right to ax the deal.

Fujifilm (FUJIF) shares were trading 1.6% higher in Tokyo.

2. Trump's ZTE U-turn: President Donald Trump announced Sunday he is working to give China's sanctioned ZTE (ZTCOF) "a way to get back into business, fast."

It was a sudden and unexpected shift in the US stance at the start of an important week for trade ties between the world's top two economies. A second round of trade talks is due to begin on Tuesday.

The US Commerce Department banned the company from buying components from American firms last month, a move that prompted ZTE to declare that it was shutting down its major business operations.

3. Trade goes crypto: ING Bank and HSBC (HSBC) announced Sunday that they have conducted their first trade transaction using blockchain technology.

The two banks used Corda, a blockchain technology developed specifically for business, to finance a shipment of soya beans from Argentina to Malaysia for global commodities trader Cargill.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

4. Markets winning streak: The Dow Jones industrial average gained 0.4% on Friday, extending its winning streak to seven days -- the longest stretch of consecutive daily gains since November.

The S&P 500 was up 0.2% on Friday. The index added 2.4% in the week, its best weekly performance in two months. The Nasdaq was flat on Friday.

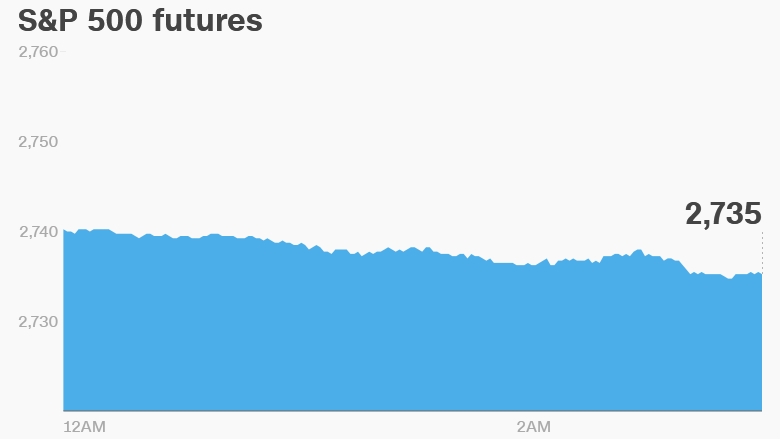

The gains could go on: US stock futures were pointing higher on Monday.

European markets opened lower, while stocks in Asian ended the session mixed.

US crude futures were 0.6% lower on Monday, trading at $70.30 per barrel. Recent sharp gains in crude prices are helping big oil stocks, but hurting drivers.

Gasoline prices are up 22% this year to a national average of $2.86 a gallon, according to AAA. Drivers in 10 states are already paying $3 or more.

5. Stock market movers: Shares in IWG, the parent company of office provider Regus, surged almost 20% in London on Monday, after the company revealed takeover offers from three separate companies.

Markets Now newsletter: Get a global markets snapshot in your inbox every afternoon. Sign up now!

6. Coming this week:

Tuesday — Home Depot earnings; US-China trade talks; USTR hearing starts; US retail sales

Wednesday — Macy's earnings

Thursday — JCPenney (JCP), Nordstrom earnings

Friday — Campbell Soup (CPB) earnings