1. Market turmoil: Global markets were mixed Wednesday following a selloff sparked by fears over Italy's escalating political crisis and renewed US-China trade tensions.

Asian markets were hit badly by the uncertainty, with Japan's Nikkei closing down 1.5%. Hong Kong's Hang Seng shed 1.4%, while China's Shanghai Composite dropped 2.5%.

European markets opened mixed, with Italy's benchmark index advancing 1% following several days of heavy losses.

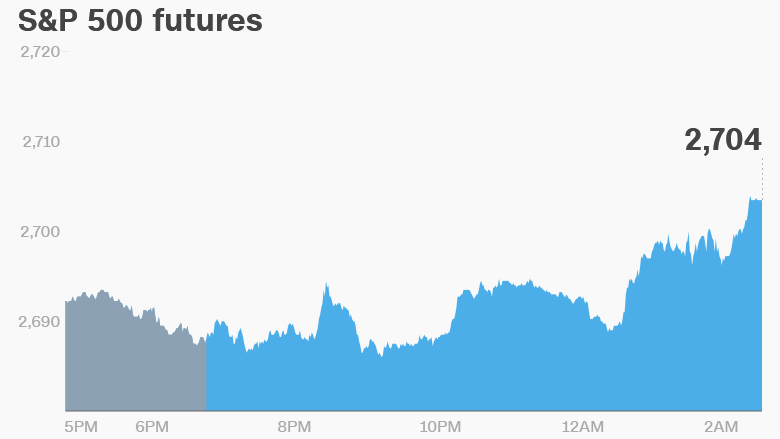

US stock futures were pointing higher.

The Dow slumped 1.6% on Tuesday, the S&P 500 dropped 1.2% and the Nasdaq shed 0.5%. Banks were the biggest losers, with Citigroup (C), Bank of America (BAC) and JPMorgan Chase (JPJQL) sliding 4%. Morgan Stanley (MS) declined 6%.

2. Italy in crisis: Italy will test the faith of investors on Wednesday when it tries to sell €6 billion ($7 billion) of government bonds.

Italy is heading for new elections after populist politicians failed to form a government, and the vote could turn into a de-facto referendum on the euro.

Investors are worried that political turmoil in Italy could cause pain beyond the country's borders. Yields on Spanish, Portuguese and Greek debt have surged.

Italian bonds prices have crashed in recent days, but were steadier early Wednesday. The auction will conclude at 5:00 a.m. ET.

3. Trade war back on: The White House announced Tuesday that it would impose 25% tariffs on $50 billion worth of goods from China, and place new limits on Chinese investments in US high-tech industries.

The world's two biggest economies held two rounds of trade talks this month. They agreed China would "significantly increase" purchases of US goods and services to reduce their trade imbalance, a top Trump administration demand, and pledged to continue talks.

In a statement, China's Commerce Ministry said the announcement is "obviously in violation" of the recent agreement.

Beijing has previously pledged to retaliate against the 25% tariffs.

4. The Volcker Rule decision time: The US Federal Reserve will meet to discuss possible changes to the Volcker Rule, a controversial part of Wall Street reform following the financial crisis.

The rule prevents banks like Goldman Sachs (GS) or JPMorgan (JPM) from making risky wagers with their own money, and also from owning big stakes in hedge funds or private equity firms.

Wall Street has complained about the rule for years.

5. Martin Sorrell is back: Martin Sorrell says he has taken control of Derriston, a listed shell company in London.

The reverse takeover deal will see Derriston transformed into S4 Capital, a "multi-national communication services business," according to an announcement.

In April, Sorrell resigned from ad agency WPP (WPPGY) after three decades as CEO amid an investigation into "personal misconduct."

Before the Bell newsletter: Key market news. In your inbox. Subscribe now

6. Companies and economics: Dick's Sporting Goods (DKS), DSW (DSW), Michael Kors (KORS) and Sears Holdings (SHLD) will release earnings before the open. Guess? (GES) will follow after the close.

Salesforce (CRM) shares jumped higher in extended trading after the company reported better than expected earnings.

Markets Now newsletter: Get a global markets snapshot in your inbox every afternoon. Sign up now!

7. Coming this week:

Wednesday — Amazon (AMZN), Exxon Mobil (XOM), Twitter (TWTR), Walmart (WMT) annual shareholder meetings; Fed discusses Volcker Rule

Thursday — Facebook annual shareholder meeting

Friday — May jobs report