|

|

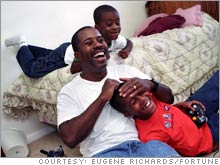

| The Butler family won't let loans against their home exceed what they paid for it. |

|

|

|

|

|

NEW YORK (FORTUNE) -

The lesson that equity can evaporate quickly is something Brooks and Judy Butler of Coral Springs, Fla., learned the hard way.

In 1989, Brooks, a sales executive for software company DataCore and a former IBMer, bought a condo in Hartford, right around the corner from the Mark Twain and Harriet Beecher Stowe homesteads. Housing prices had soared by more than 90 percent in the previous four years, and a few weeks after he plunked down $98,000, a similar condo sold for $125,000, which made him feel pretty good.

But then the insurance industry went into a slump, and Hartford's population declined. As the years went on, units in his building started to change hands for less and less.

Brooks thought about selling when he was $4,000 down, but he couldn't afford to lose that kind of money. The next time he thought about it, he was $25,000 in the hole.

When he finally cashed out in 1998, he had to bring a $40,000 check to the table. "It was awful," he says. (The condo, he heard, sold two years ago for $82,000 -- still short of its 1989 level.)

Which is why, as a matter of family philosophy, Brooks and Judy refuse to believe their current house in Florida is worth a single penny more than $210,000 -- the price they paid five years ago -- even though comparable dwellings on the street are going for close to $500,000.

Their rule: Never allow outstanding loans against the house to surpass the purchase price. In fact, their mortgage and the $9,000 they took out on a home-equity line of credit are considerably less, they say.

And where did they put that $9,000? Back into the house. They refurbished the deck and the driveway and purchased hurricane shutters. "That's a conservative approach," says Brooks. "If we stick to it, we'll be safe."

Americans have increased their home equity in the past five years by 60 percent, or more than $3.6 trillion. They have also tapped it -- to the tune of $600 billion in 2004 alone.

Some of this cash has been spent wisely: to put the kids through college, for instance. But plenty has gone toward vacations and new wheels. Great for the economy; bad for many personal balance sheets.

"A new kitchen is fine because it adds real value to your home," says Leamer. "But to buy an SUV and go out to fancy meals with expensive wines, that's spending money you may never have."

Clearly, the message of the forecast is that appreciation may not always support such spending. Some 60 percent of homeowners, according to one recent survey, expect at least 5 percent annual price growth during the next several years.

That may not sound extreme, but in dollar terms, on today's already hefty home prices, it certainly adds up.

And -- surprise -- it's way out of touch with historical norms: Home prices have risen slightly more than 1 percent annually after inflation. Chances are, appreciation in the future will look more like that, at best, than like the heady figures we've seen in recent years.

The takeaway: "Your home isn't worth as much as you think it is," says Economy.com's Zandi. "So borrow as if it were worth measurably less, because it is."

_______________

More questions:

Is it time to cash out?

Could renting be smarter?

Should you rethink your mortgage?

Plus: Exclusive forecast for 100 markets

|