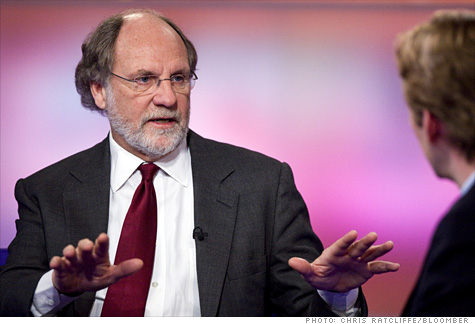

(Fortune) -- Is it fun yet, Jon? It was just like old times for former Goldman Sachs CEO, U.S. Senator, and Governor of New Jersey Jon Corzine when he faced Wall Street and the press yesterday in his new role as chairman and CEO of little-known brokerage firm MF Global. "Let me state the obvious," he said when reporting a disappointing quarter. "These are not the kinds of results that MF Global management will tolerate, nor should its shareholders."

What about Jon Corzine? Why should he tolerate them? Why on earth has the bearded and becardiganed hectomillionaire chosen to submit himself to playing the game at such a small level? Can it really be as he says -- that he's taken on a turnaround challenge at a brokerage with a reputational problem, a capacity for overpaying its employees, and an incomplete product line -- because it's what he really wanted to do? (MF Global: Sorting through the debacle.)

Some background: MF Global (MF), which specializes in brokering exchange-listed futures and options, pulled down $1 billion in net revenues in the fiscal year ended March 31. Not tiny by any means, but no major player either. After being spun off from hedge fund giant Man Group in a 2007 IPO, it's been downhill ever since: shares peaked at $31 that year; they were at $8.20 as of yesterday. A rogue trader who lost $141 million betting on wheat (!) in 2008 was indicted last month. And controls are typical Wall Street: The proportion of net revenues paid out as compensation are an absurd 65%, well above the egregious levels of financial institutions you already knew the name of.

So what's he doing there again? Last week, The New York Times floated the idea that the new gig was some sort of "bid for redemption." All the ingredients were there: a Goldman (GS, Fortune 500) pedigree that has lost (some of) its cache, a once-promising political career derailed in the swamp of New Jersey's fiscal challenges, a guy who just loves to get up and go into the office each day. He's built before; he will build again.

"Goldman was small when I joined it, too," he told the Times. That's a little disingenuous, Jon. You joined Goldman in 1975. The firm was well established as a major player on the financial scene at the time, having lead-managed the IPO of Ford (F, Fortune 500) in 1956, and the revolving door between Goldman and Washington had already been established. It may have been much smaller than it is today, but people did know the firm's name. Even after Corzine's surprise arrival at MF Global in March, however, the firm remains practically unknown outside Wall Street.

Seemingly committed

The paper wasn't alone in buying Corzine's suggestion that he's found a new home. Analysts covering MF Global have been taking Corzine at his word as well. "We believe Mr. Corzine seems committed to MF for several years," says analyst Niamh Alexander of Keefe, Bruyette & Woods. But note the hedging: believing someone "seems committed" isn't exactly the same as going all-in.

The usual route for an erstwhile big-time CEO who wants to keep some skin in the game is to join a private equity firm -- in other words, he's got some money, he's got some connections, and he's ready for a steady, fat paycheck. Think Lou Gerstner at the Carlyle Group. Corzine hasn't departed from this route entirely -- he signed on as a partner at JC Flowers & Co., a private equity firm run by his old Goldman pal Christopher Flowers. "After he lost the election, we had extensive discussions about him coming on board," Flowers told me yesterday. "And we're delighted to have someone of his stature and experience at our company."

Where Corzine did depart is by taking an operating role at one of the companies the private equity firm has invested in -- JC Flowers owns 10% of MF Global. It's not unprecedented, but is it really necessary? Sure, he's getting the fat paycheck: a signing bonus of $1.5 million, a $1.5 million salary, and a $3 million bonus target. But the guy is 63, for God's sake. How much more money does he need?

There's another way of looking at it, though: Given the JC Flowers stake, Corzine is actually just protecting an investment he's already made. "We're generally long-term shareholders," says Flowers. "And with Jon in there, that reinforces that. To make the most of this investment will take several years."

And it looks like that investment needs the help. Just two months into the job, Corzine is earning his keep by announcing impending personnel cuts of 10% to 15% as well as slashed compensation going forward. There's gonna be some real happy campers in that place in the weeks and months ahead.

The question, once again: Why did he take this job? Jon Corzine doesn't really need "redemption," no matter what the Times tells you. Nor -- after all that is New Jersey -- does he need another intractable problem to solve. Did someone say glutton for punishment? ![]()