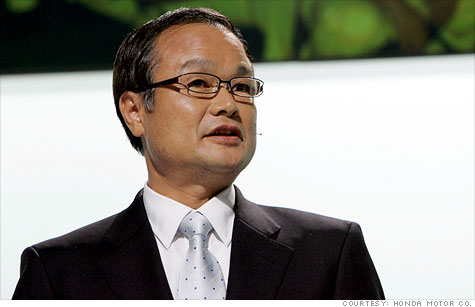

Like all his predecessors, Honda's latest CEO, Takanobu Ito, worked his way up through Honda's famed R&D unit.

FORTUNE -- For years, Honda has been considered the ultimate playground of engineers. They rode to work on their Honda motorcycles and got to explore speculative projects like jet airplanes and humanoid robots. With a long list of technical achievements dating back to the CVCC engine of the 1970s (it produced a clean exhaust without a catalytic converter), they were rightly proud of their heritage and enjoyed an elite status within the company.

The result has been a hothouse culture where creativity is king, attention focuses inward, and marketability falls low down the list of corporate priorities. It was Honda that developed the first hybrid -- not Toyota -- but by stubbornly sticking to a bare-bones system, it long ago lost its leadership to its number one Japanese rival. A revolutionary pickup truck with a unibody construction, the Ridgeline, remains a market outlier. Meanwhile, recent product innovations, like the Honda Crosstour and Acura ZDX hatchbacks, were widely panned upon introduction and failed to gain traction in the marketplace.

The most recent evidence of Honda's insensitivity to customer needs is the 2012 Civic. Rather than taking note of growing buyer preferences for more comfortable small cars, it produced a simpler vehicle that failed to win a recommendation from Consumer Reports, a bible for many Honda customers. The Civic's success is critical to Honda because, along with Accord, it accounted for a hefty 83% of Honda's passenger car sales in the first half of 2011.

It didn't help when Honda's operations were severely disrupted by the earthquake and tsunami in March. The automaker has struggled to right itself, and its financial results have taken a severe hit. Revenues fell 27% in the first quarter, and its operating profit nearly disappeared.

Honda is suffering at the very moment when its two main Japanese rivals are thriving. Toyota is getting a jolt of energy from Akio Toyoda, scion of the founding family, while the ever-energetic Carlos Ghosn has made Nissan the leader in electric cars.

Which perhaps illustrates another part of Honda's problem: Ask 100 people in the auto industry who is the president and CEO of Honda, and the response from 99 of them will be a blank stare.

Since the retirement of the charismatic Nobuhiko Kawamoto in 1998, Honda has been led by a succession of relatively faceless engineers. The latest is Takanobu Ito, who, like all his predecessors, worked his way up through Honda's famed R&D unit. Ito, who turns 58 later this month, is best known as a chassis engineer on cars like the Acura NSX. He recently caused a stir by hopping on his Honda motorcycle and visiting Honda's heavily damaged Tochigi operation two days after the earthquake. Later, he posed for photographers atop his bike, improbably clad in a suit and tie.

Ito turns up in the automotive press from time to time, where he is quoted on such topics as the future of electric cars (Honda will have one in 2012) or the revival of the NSX (he's considering it). Rarely though is he heard musing about Honda's failures in product development, or its inability to cash in on the growing allure of small cars, or the continued failure of its Acura brand to gain traction.

What Honda needs, in part, is what every company needs from time to time: a jolt of new energy and a rededication to core values -- in Honda's case, "man maximum, machine minimum." A spinoff of the Hondajet operation, which won't deliver its first plane into a now-depressed market until a year from now, would eliminate executive distraction.

More than that, Honda needs to take a hard look at itself and, like a baseball team at free agent time, fill in the parts of its lineup where it is weak. That may include doing the unthinkable for Honda: recruiting some talented outsiders to take a fresh look at the market and its customers. With competitive new offerings from General Motors (GM, Fortune 500) and Ford (F, Fortune 500), Hyundai now in the mix, and Toyota about to unleash a product onslaught, Honda needs to stop playing with robots and refocus on the car business. ![]()