FORTUNE -- Roger Ferguson radiates calm, an excellent quality for a leader to display during turbulent times. Good thing, because he's getting plenty of practice lately. The former vice chairman of the Federal Reserve took over as CEO of retirement services powerhouse TIAA-CREF just before financial markets imploded in 2008. Now a new round of economic uncertainty and market volatility has posed an investing challenge to his company, which manages retirement funds for 3.7 million Americans. Adding to the tension, Standard & Poor's recently downgraded the $453 billion asset-management company's AAA credit rating to AA+. Fortune spoke with Ferguson, 59, about his economic forecast, the best moves for investors now, and what effect the rating cut will have on his company.

Q. It's been a volatile summer. What's your market outlook now?

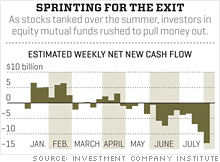

A. The volatility we've seen so far has been a reflection of uncertainty about U.S. economic growth and some of the sovereign-debt issues that have arisen in Europe. Those issues won't be resolved in the near term, so all of us should be prepared for more volatility.

Are we entering a new recession?

I don't think so. The odds have gone up a little because data has been weaker. But it's more likely that we'll have relatively slow growth than it is that we'll fall back into a technical recession.

What should investors do in times of uncertainty like this?

Tune out the noise. It's important for investors to develop a solid sense of their own risk appetites and an investment plan that they can execute through the ups and downs. Finally, recognize that periods of volatility also present opportunities. Put what is happening now into a broader context. After this period of volatility, a recovery will undoubtedly follow.

What is TIAA-CREF doing with its portfolios to manage volatility?

We are fully invested. We're long-term investors who believe in diversification. Having said that, we're looking at this as an opportunity to get what we think are good assets at prices that at this stage are very attractive. We're looking across all asset classes. For example, we are making investments in commercial real estate. It's time to look at everything on a risk/return basis.

Is the Fed right to keep rates low through 2013?

When I was at the Fed, I found it was not always helpful when former governors would publicly grade what we were doing. But what the Fed is doing is removing a certain degree of uncertainty. That then allows individuals to plan for a low-interest-rate environment. Keeping rates low helps support the healing that needs to go on in the American economy.

The effect: Yes, you should expect new money you put into fixed income to have a relatively low interest rate. This indirectly encourages people and institutional investors looking for a return to think about asset classes beyond fixed income.

What do S&P's downgrade of the U.S. and the debt problems in Europe mean for investors?

First, a credit rating is one institution's opinion. Clearly S&P's opinion is influential, but other opinions are influential as well. We have to recognize that the Treasury market is the deepest and most liquid of markets, and we've seen safe-haven flows into U.S. debt that show that the full faith and credit have not been shaken.

The U.S. and Europe are working through difficult challenges, but they are not totally intractable. Honestly, we are now confronting a period of slower growth, which could last longer than anyone would like. But we will someday be talking about economic growth and even upside risk.

TIAA-CREF was downgraded by S&P too. Is that a concern?

S&P has a view that no domestic insurance company can have a rating that is higher than the sovereign rating. The downgrade was driven by S&P policy, as opposed to a reassessment of company fundamentals. We continue to have the largest capital cushion in the history of the company. We pay our annuitants, and they will continue to be paid appropriately. We have ample liquidity to respond to any needs.

Entitlement cuts resulted from the debt-ceiling fight. Should we be worried about Social Security?

I can't speculate about what might happen with the congressional supercommittee and all the processes that will happen. But we have short-, intermediate-, and long-term problems to address. So far we've been focused on the short term. In the intermediate term the U.S. must figure out how to put its fiscal house in order, and I'll leave it to the politicians to figure out that mix of revenue vs. expenditure. In the long term, we have to move the entire economy a little bit more toward saving and investment -- toward exports and less toward consumption. No matter what happens, the U.S. is moving toward a more saving-oriented economy.

This article is from the September 5, 2011 issue of Fortune. ![]()

Carlos Rodriguez is trying to rid himself of $15,000 in credit card debt, while paying his mortgage and saving for his son's college education.

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: