Markets are refocusing their attention on the Federal Reserve after last week's geopolitical roller coaster ride.

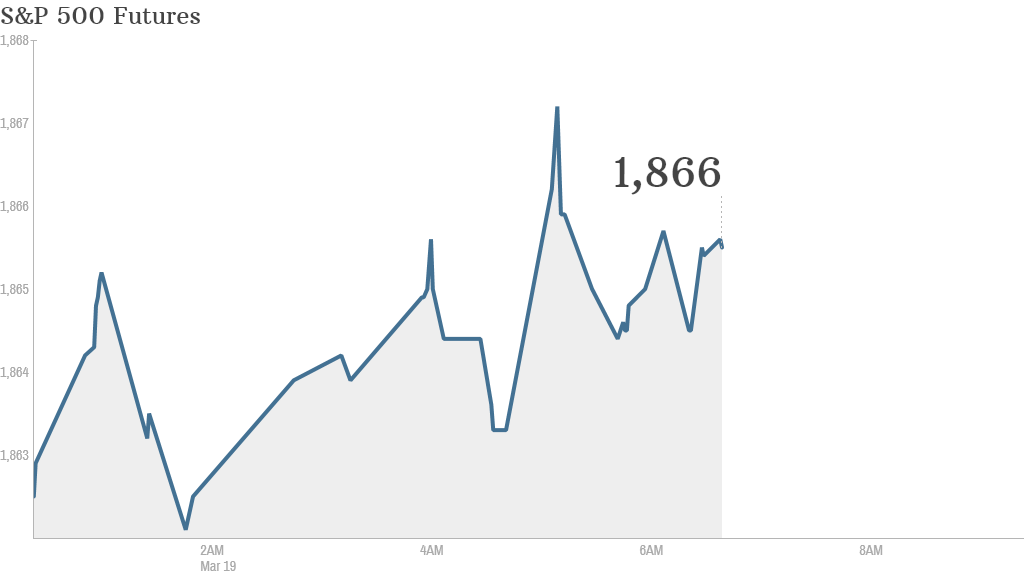

U.S. stock futures were slightly higher ahead of the market open.

The Fed's Open Market Committee concludes its two-day policy meeting Wednesday afternoon, and investors seem happy shifting their focus from Russia's takeover of Ukraine's Crimean peninsula to the FOMC.

"Happy FOMC and Budget Day," wrote Societe Generale strategist Kit Juckes in a note to investors. "And apparently, happy 'ignore everything going on in Crimea' day, too."

It's Janet Yellen's first meeting in charge of the Fed and investors are looking forward to hearing from her after the meeting.

The Fed is widely expected to continue trimming its asset purchase program by another $10 billion, to $55 billion a month. The stimulus program was created to support the U.S. economy and has also been a key driver behind the equity bull market.

Related: 4 things to expect from Yellen's Fed

Investors and traders will also listen closely for any possible Fed plans to revamp its strategy on interest rate guidance.

The central bank has said it will only raise interest rates once unemployment falls to around 6.5%, or inflation rises as high as 2.5%. It's possible Yellen may abandon these numerical targets to focus on qualitative information instead.

And the latest reading of CNNMoney's Fear & Greed index shows market sentiment is in 'neutral' territory.

Related: Fear & Greed Index still idling in neutral

In corporate news, FedEx (FDX)and General Mills (GIS) will report earnings before the opening bell.

Oracle (ORCL) shares fell in premarket trading after reporting revenue that fell short of Wall Street expectations. Shares in Pacific Sunwear (PSUN) rose in premarket trading after the firm posted a loss that was narrower than expected.

U.S. stocks closed higher Tuesday. The Dow Jones industrial average and S&P 500 were each up more than 0.5% while the Nasdaq surged by more than 1%. Tuesday was the Dow's second consecutive day of gains.

European markets were mixed in morning trading.

Asian markets were muted Wednesday and ended with mixed results. The Nikkei in Japan edged up by 0.4%.