Markets are looking perky, shares in HP are set to surge and we've got a big healthcare takeover on our hands. It's going to be a busy day.

Here are the five things you need to know before the opening bell rings in New York:

1. Happy HP: It looks like Hewlett-Packard's (HPQ) stock is about to soar Monday after reports that the company is looking to split itself up.

The Wall Street Journal cited unnamed sources who said the company would separate its PC and printer operations from its corporate software and services business. The official HP announcement could come as soon as Monday, it said.

Shares in the firm were rising by 6% premarket.

Related: Wall Street's beer goggles are clearing up

2. Merger Monday: Two healthcare companies have announced a $12.2 billion takeover deal.

Medical technology firm Becton, Dickinson and Co (BDX) is taking over CareFusion (CFN) in a cash and stock deal that values CareFusion shares at $58 each.

CareFusion's stock was rising by 25% premarket to hover just below the $58 mark.

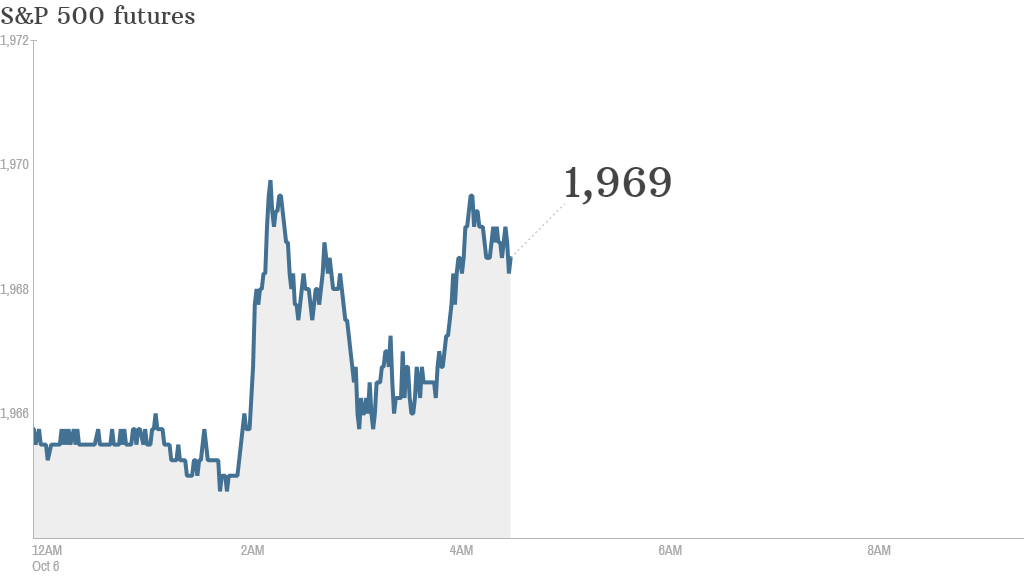

3. Rising in the face of fear: CNNMoney's Fear & Greed index indicates investors are still feeling fearful, yet U.S. stock futures are edging higher.

Asian markets ended with mixed results, though Chinese stocks were mostly positive. The Hang Seng in Hong Kong rose by 1.1% as pro-democracy protests wound down. The index was volatile last week as protests swelled across the city.

The positive mood continued in Europe in early trading, despite more gloomy economic data from Germany and the eurozone. The Dax in Germany was up by 1.2%. German markets were closed Friday, missing out on gains inspired by a strong U.S. jobs report.

4. Earnings: The Container Store (TCS) will report earnings after the closing bell.

Later in the week, we'll hear from Yum! Brands (YUM), which has been struggling after a tainted food scare in China.

5. Friday recap: U.S. stocks rebounded Friday on the strong jobs report. The Dow Jones industrial average gained 208 points, although it still had a down week. The S&P 500 and the Nasdaq both rose more than 1%.