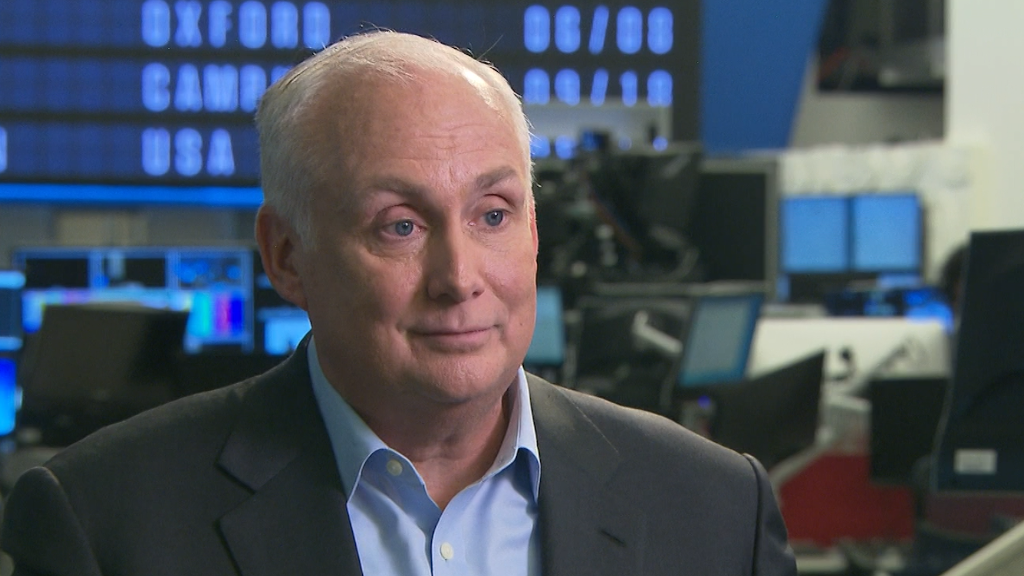

Ken Chenault has been the CEO of American Express for more than 14 years. But does he now have to watch his back?

Shares of American Express (AXP) have fallen 13% so far this year, making it one of the worst-performing stocks in the Dow. And last year, shares barely budged.

But the stock popped more than 6% late Friday after Bloomberg reported that the hedge fund ValueAct had taken a $1 billion stake in AmEx. That's because ValueAct is known for trying to shake things up at companies it invests in.

ValueAct has not filed anything with the Securities and Exchange Commission as of yet about AmEx. The company was not immediately available for comment.

AmEx spokeswoman Marina Norville said in an e-mail that the company has been speaking with ValueAct and that AmEx looks forward "to continuing a constructive dialogue."

But she would not comment on whether or not ValueAct -- which she referred to as a "well-respected firm" -- is currently an investor in the company.

Related: AmEx offers new rewards program ... with no AmEx Card required

Still, there is reason for AmEx's executive team -- and Chenault specifically -- to be concerned if ValueAct has bought a stake.

ValueAct, led by Jeff Ubben, created a stir after investing in Microsoft (MSFT) two years ago.

Pressure from ValueAct is cited as one reason why Steve Ballmer is now the owner of the Los Angeles Clippers basketball team and no longer the CEO of Microsoft.

Ballmer announced he would be stepping down in August 2013 -- four months after ValueAct first disclosed its stake. Ballmer officially left in February 2014. And ValueAct president Mason Morfit was named to Microsoft's board one month later.

Ubben isn't as vocal as fellow activists Carl Icahn, Bill Ackman, Dan Loeb and Nelson Peltz -- who often write harsh letters to company executives and take to TV and Twitter to make their case for change.

Instead, Ubben is widely believed to be very good at negotiating out of the public eye.

The fund still owns Microsoft and also has investments in drugmaker Valeant (VRX), merging oil services companies Halliburton (HAL) and Baker Hughes (BHI) and British jet engine marker Rolls-Royce (RYCEF).

Related: AmEx rejected by Costco and Wall Street

In some respects, AmEx's current problems are similar to Microsoft's a few years ago.

AmEx is struggling to grow its sales and profits at a time when rivals are doing well. Revenue was up just 3% in 2014 and analysts expect it to fall 1% this year and that earnings will rise just 2%.

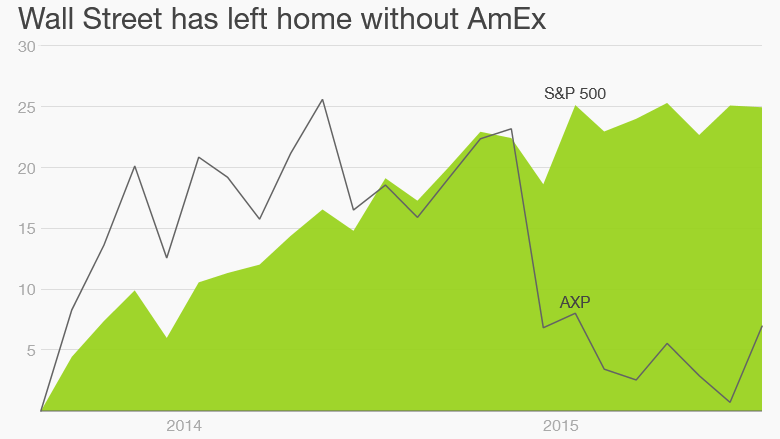

As a result of this lackluster performance, AmEx's stock price has been stagnant compared to the broader market and competitors lately.

Shares of AmEx are up just 6% in the past two years while MasterCard (MA) and Visa (V) are up 56% and 65% respectively.

Investors are unsure how AmEx will replace its deal as credit card partner of Costco (COST), which ends in a few months.

Costco is partnering with Citigroup (C) and Visa starting next April. JetBlue (JBLU) is also ending its partnership with AmEx in favor of a new credit card deal with Barclays (BCS) and MasterCard.

Investors are clearly not happy with AmEx. So if Ubben did purchase an AmEx stake, it will be interesting to see just what he wants done differently.

Pushing out Chenault might not be the answer though since there is no logical heir apparent. Former AmEx president Ed Gilligan passed away suddenly in May.

Related: AmEx president Ed Gilligan dies at 55

It may also be difficult for Ubben to convince AmEx to make big changes unless he gets the backing of other top shareholders.

A billion dollar stake is significant. But AmEx's biggest investor is Warren Buffett's Berkshire Hathaway (BRKA), which has an 8.6% position in the company worth $12 billion.

Buffett has repeatedly referred to AmEx -- along with Wells Fargo, Coke and IBM -- as his "Big Four" holdings.

In this year's shareholder letter, Buffett addressed the fact that some of those companies have been lagging the market. He did not single out AmEx or Chenault but issued a blanket defense of the Big Four.

He said they all "possess excellent businesses and are run by managers who are both talented and shareholder-oriented." (This was written before Kraft and Heinz merged. Kraft Heinz is now Berkshire's second-largest position. So I guess Buffett now technically has a "Big Five.")

Buffett commented on the rise of activist investors at this year's shareholder meeting in May. He said that when companies complain about being targeted, they could sell to Berkshire. "We'd love to have them," he said.

But it's doubtful Berkshire could pull off a purchase of AmEx if Ubben did start agitating for change. AmEx is currently worth $81 billion. And Berkshire just plunked down $37 billion on Monday to buy Precision Castparts (PCP).

Ironically enough, Ubben should thank Buffett for that. ValueAct bought a small stake in Precision Castparts during the first quarter. The stock rose nearly 20% Monday.