P/E Ratio: 16

Yield: 1.9%

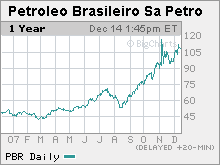

The Hottest Fund Manager in America - a.k.a. CGM's Ken Heebner - laid out an argument that $100 oil is not only coming but will be here to stay. "There is still strong growth in Latin America, China, India, and a host of smaller countries like Poland and Thailand," he says. That means a need for some 1.5 million more barrels of oil a day. That brings us to Petrobras, Brazil's largest oil company and the stock Heebner thinks is the best way to play oil right now. With petroleum prices so high, a big risk for oil companies is that host countries will demand a bigger share of the profits in the form of taxes or royalties. "One way you can avoid this," says Heebner, "is if the government owns half the company you've invested in. That's Petrobras."

Petrobras is cheap enough, at 16 times earnings, that it can be a winning investment even if Heebner is proven wrong about $100 oil. The company just announced a huge find offshore from Rio de Janeiro, a field said to have up to eight billion barrels of recoverable oil.

Correction: An earlier version of this gallery mislabeled the ticker for the oil company Petrobras. The correct ticker symbol is PBR, not PZE (which is a Petrobras affiliate). As a result, the earlier version also listed stock data, P/E ratio and yield for PZE, not the parent company (PBR).

Last updated January 02 2008: 5:32 PM ET