Retire without taxes

Only one savings plan gives you the chance to free yourself from taxes in retirement. Are you making the most of it?

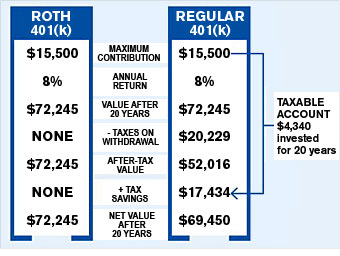

Think of it this way. If you're in the 28% bracket, contributing $15,500 in after-tax dollars to a Roth is the equivalent of socking away $21,528 in pretax dollars in a regular 401(k) because you'll have to pay taxes eventually on the regular plan's withdrawals. But you can't put that much in a 401(k). To match the Roth, you'd have to put $15,500 in a your regular 401(k) and then invest the remaining $6,028 outside the plan. You'd owe income taxes on that $6,028, which leaves you with $4,340 in a taxable account (where taxes will drag down your returns).

As the graphic shows, the combined after-tax value of your 401(k) and taxable account would be smaller than the Roth's tax-free balance.

One warning: If you switch your $15,500 from a regular 401(k) to a Roth 401(k), every other week your paycheck will be $167 smaller (at a 28% tax rate) because of lost tax savings.

The second wrinkle is changing tax rates. This example assumes that you'll be in the same tax bracket when you retire as you are today. But if your rate is higher in retirement, a Roth becomes an even better deal because you paid taxes at today's relatively low rate. If you fall into a lower tax bracket, paying taxes later would likely win out.

NEXT: How can I know my future tax bracket?

Last updated September 16 2008: 11:34 AM ET

Source: Money research.

Notes: Assumes 28% tax bracket before and after retirement; 8% annual return for taxable account includes 1.79% dividend yield and a 15% tax on long-term capital gains, for a 7.2% annual after-tax return.

Notes: Assumes 28% tax bracket before and after retirement; 8% annual return for taxable account includes 1.79% dividend yield and a 15% tax on long-term capital gains, for a 7.2% annual after-tax return.