Special Offer

Saving the bond insurers: 5 fixes for the crisis

Just about everyone seems to have an idea on how to fix the troubled bond insurers and stave off a crisis that threatens to send the financial services sector into disarray.

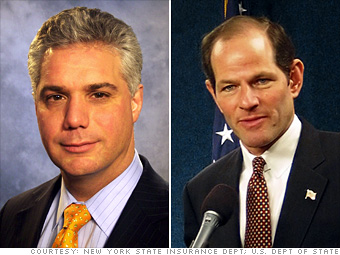

New York Insurance Department Superintendent Eric Dinallo (left) and New York Gov. Eliot Spitzer.

The prospects: Likely. Of all the different solutions being floated, this proposal has garnered the most interest. After the bond insurer FGIC was downgraded last week by Moody's, the company asked Dinallo's office for permission to break itself up. Its larger rivals Ambac and MBIA are also reportedly considering similar moves.

A break-up would prevent cities and towns - which buy insurance on bonds they sell to raise money for projects like roads, schools and bridges - from getting saddled with higher borrowing costs. But it is widely believed that, after a split, the structured finance arm would wither and die, meaning downgrades on the asset-backed securities issued by Wall Street and more writedowns.

NEXT: Uncle Warren to the rescue

Last updated February 21 2008: 4:48 PM ET