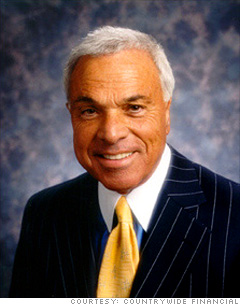

"The truth is that the last thing we ever want is for people to lose their homes. Our core commitment is to put people in homes and to keep them there." -- Testimony before House Committee on Oversight and Government Reform, March 7, 2008

Surely Mozilo was kidding or delusional when he bragged earlier this year that his company had "helped millions of people in good times and bad." What's indisputable is that Mozilo, who founded Countrywide decades ago in a New York apartment, helped himself to stunning compensation during a period when his company was tossing its unsuspecting customers subprime stink bombs.

In its quest to originate nearly one out of every three home loans in the nation, Countrywide lent money to just about anyone who could grasp a pen. It didn't matter if borrowers defaulted, because Countrywide bundled questionable loans and sold them on the secondary market, where they became somebody else's nightmare.

Countrywide's borrowers were often lured into selecting loans with teaser rates that quickly vanished. States such as California and Florida launched civil prosecutions against Mozilo and his corporation for misconduct, including using high-pressure tactics to push risky loans even when customers could have qualified for cheaper ones.

What was Mozilo's motivation? Benjamin Diehl, a California deputy attorney general, thinks he knows: "Greed." --L.O.

NEXT: Zero: Richard Fuld

Last updated December 12 2008: 6:01 AM ET