Special Offer

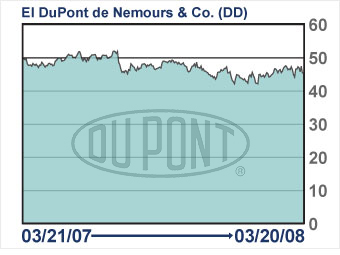

Share price as of March 20: $45.45

P/E ratio: 13.2

Rising earnings forecasts, a hefty 62% of sales from overseas, and a relatively skinny P/E ratio make this stock look like a winner.

Sales of agricultural chemicals in developing countries are a particularly bright spot.

And the stock's 3.6% yield means that you get paid handsomely to wait for the market to recover.

NEXT: General Electric

Last updated April 10 2008: 4:48 PM ET