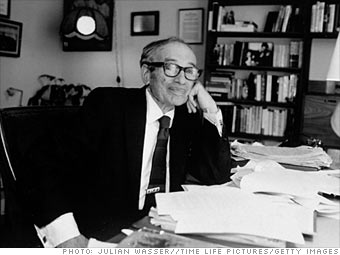

Manager, First Eagle Funds

It was 1968, and I was in Central Park with two French students who told me about Benjamin Graham's book, "The Intelligent Investor," which turned out to be about common sense. It has three lessons. The first is humility, that the future is uncertain. There are people on Wall Street who will predict the Dow will be at a certain level, but that is nonsense. The second thing is that because the future is uncertain, there's a need for caution.

The third thing was especially important. Graham values the idea that securities can be more than just paper. You should try to figure out the intrinsic value of a business. In the short term, the market is a voting machine where people vote with their dollars, but in the long term, it's a weighing machine that measures the realities of business.

NEXT: Always get it in writing