Secrets of 6 top financial advisers

Some of the financial planning profession's most respected veterans reveal their favorite strategies for tough times.

Client assets: $650 million

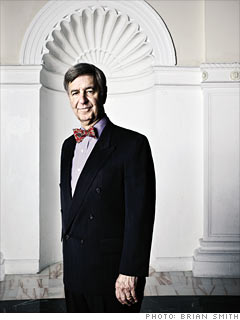

Known for: Former chairman, Certified Financial Planner Board of Standards

Harold Evensky - The dean

Evensky & Katz, Coral Gables, Fla.

In retirement, if you start taking money out of stocks at the wrong time, you're in trouble: "Gosh, the market's down, but I've got to sell because I need groceries." So I developed the cash-flow-reserve strategy.

We don't believe in investing in stocks or bonds unless we expect to hold on for at least five years. Problem is, carving five years' worth of cash out of a portfolio puts too big a chunk in money markets. There's an opportunity cost to not being in the market. Two years of cash provides a significant cushion.

So if someone has a million dollars and needs 5% a year - $50,000 - we have two portfolios: a $900,000 stock and bond portfolio, and a $100,000 cash reserve. Maybe put the first year in a money-market account and the second in a short-term bond fund.

We've never run out of cash, but if we did, we would simply sell short-term bonds in the investment portfolio. We wouldn't have to sell stocks or long-term bonds when they're in the tank. The system worked well in the crash of '87 and the tech crash, and it's working very well now.

NEXT: The secret to avoiding a high tax bill