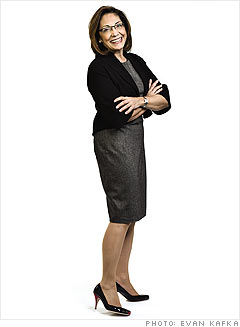

Age: 58

In 2000, sales exec Julia Andres had $775,000, nearly all of her retirement savings, invested in Citigroup, where she'd worked for more than 20 years. Even though she'd left the company a year earlier to join another financial services firm, Julia held on to her stock. "I trusted Citi because I'd been there for so many years," she says. That is, until the shares lost 50% of their value in the 2002 market downturn.

The following year, working with MetLife financial planner Dwight Raiford, Andres mapped out a plan to slowly diversify her portfolio. With her target retirement age of 62 approaching, investing most of her savings in stocks, much less a single stock, was too risky. By the end of 2004, Andres had sold all of her Citi stock and her portfolio, split between stocks and bonds, had mostly recovered. She lost 20% in 2008 but knows it could have been far worse. Had she left her money in Citigroup stock, her portfolio would be worth about $50,000 today. --Veronica Crews

NEXT: David and Judy McMickens, Gardendale, Ala.

Last updated March 09 2009: 10:12 AM ET