What to do with $50,000 now

Low interest rates and the recent stock market surge make this a challenging time to find the best places for your extra cash.

NEXT: Make a down payment on a retirement dream

Last updated October 21 2009: 11:03 AM ET

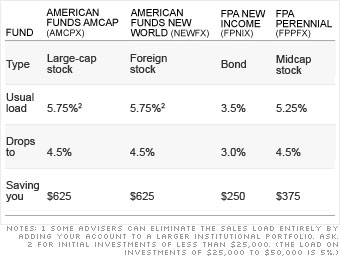

NOTES: ¹Some advisers can eliminate the sales load entirely by adding your account to a larger institutional portfolio. Ask. ²For initial investments of less than $25,000. (The load on investments of $25,000 to $50,000 is 5%.)