First, his loan servicer told him he'd have to wait until the end of July because he has private mortgage insurance.

Now, Bank of America said to him it is awaiting guidelines from the federal government on how to refinance loans for those whose mortgages are valued at 125% of the home's worth. The Obama administration adjusted the refinancing program in July to cover more homeowners whose properties have declined in value.

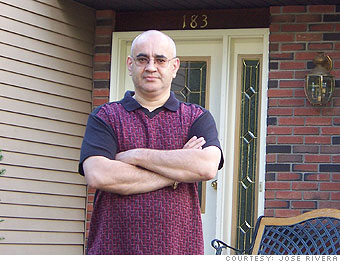

The program's expansion was critical for Rivera, whose home value has dropped by more than $50,000 to $297,000. His mortgage is now 119% of his home's worth.

Rivera, a quality analyst at a financial services company, can afford to pay his mortgage, but would like to lock in today's rates, which have hovered below 5%. He is paying 7%. Rivera, who received no raise and only 20% of his typical bonus, thinks he can save nearly $500 a month by refinancing at 5%.

"This continues to be an extremely frustrating process," he said. "This program was approved in July, but here we are in October and apparently it is still not available to people like me who qualify and could very much use the assistance from the program."

A Bank of America spokeswoman said the servicer hopes to start processing refinance applications under the expanded program soon. The bank will also see whether Rivera qualifies for a loan modification.

NEXT: 500,000 homeowners receive modifications