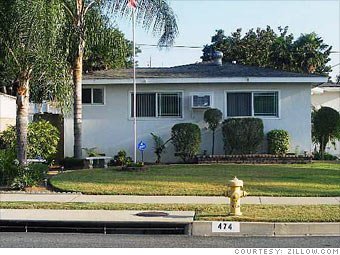

Median home price: $319,000

Median income:$59,800

Affordability score: 26.9%

The second largest metropolitan area in the country is the fourth least affordable, but home prices are improving -- a lot. They have plummeted from a high of $530,000 during the second quarter of 2007 to their current median of $319,000, according to the NAHB-Wells Fargo Housing Opportunity Index. That's an almost 40% drop.

Despite the huge price decline, only about 26.9% of the homes sold during the last three months of 2008 were affordable to those earning the median family income of $59,800. That is a huge improvement compared with late 2006, however, when barely 2% of the homes sold were affordable to the average buyer.

Meanwhile, foreclosures have become a major headache. There were nearly 97,000 properties receiving foreclosure filings last year in the LA metro area, more than double the total of 2007, and the 26th highest rate of any metro area, according to RealtyTrac.

With job losses expanding -- the unemployment rate for the area is up to 8.8% - foreclosure losses will probably continue to increase. That would put more downward pressure on prices and lead to increased housing affordability in the future.

NEXT: Miami Fla: 5th least affordable metro area

Median income:$59,800

Affordability score: 26.9%

The second largest metropolitan area in the country is the fourth least affordable, but home prices are improving -- a lot. They have plummeted from a high of $530,000 during the second quarter of 2007 to their current median of $319,000, according to the NAHB-Wells Fargo Housing Opportunity Index. That's an almost 40% drop.

Despite the huge price decline, only about 26.9% of the homes sold during the last three months of 2008 were affordable to those earning the median family income of $59,800. That is a huge improvement compared with late 2006, however, when barely 2% of the homes sold were affordable to the average buyer.

Meanwhile, foreclosures have become a major headache. There were nearly 97,000 properties receiving foreclosure filings last year in the LA metro area, more than double the total of 2007, and the 26th highest rate of any metro area, according to RealtyTrac.

With job losses expanding -- the unemployment rate for the area is up to 8.8% - foreclosure losses will probably continue to increase. That would put more downward pressure on prices and lead to increased housing affordability in the future.

NEXT: Miami Fla: 5th least affordable metro area

Last updated February 26 2009: 12:46 PM ET