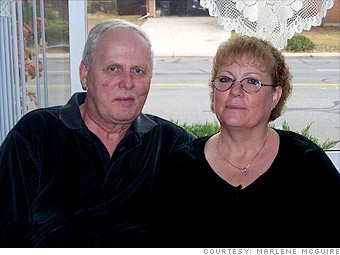

The McGuires purchased their home in 2005 and made the $1,500 a month payments faithfully. When their adjustable-rate loan began to reset, the increases were small, just $50 to $75 or so. But they added up, and soon the couple was paying more than $2,100 a month.

That was a tough nut for Marlene's husband, Bill, to manage even though he earns good money as a long-distance trucker.

The tri-level had three bedrooms upstairs and another suite in the basement. "It had all the extras," says Marlene, a homemaker in Northglenn, Colo.

Getting advice from YouWalkAway.com, a Web site that guides people through the foreclosure process, the McGuires realized that they owed much more than the property was worth and the upkeep costs were beyond what they could pay.

Even though Marlene loved her house, they opted for a short sale and found a buyer at $180,000. The lender approved the deal, and they moved out, free and clear. They continued making their regular payments each month until they left their house.

Because they were not delinquent, their credit didn't suffer too much at first, but the short sale did hit hard.They now live in a mobile home.

"That's the best we can do right now," said Marlene. "But, the stress is over. My husband and I were not getting along; there was conflict. It was making me very sick. You have to get out of the house when no one will help you."

More galleries