Throughout the housing crisis, South Dakota has been a rock. Home prices have been stable, and foreclosures have been low. In fact, the worst one-year decline in home prices in Sioux Falls came in the first quarter -- of 1982.

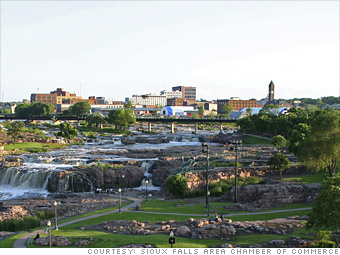

It was one of this year's Best Places to Launch, and it bills itself as the "Best Little City in America."

So seeing the city of 200,000 on the top of a foreclosure list is shocking to many. In fact, realtor Cindy Oyen of Ameri-Star Real Estate couldn't believe the city's foreclosure rate had shot up almost 120% in the last quarter.

After all, she said, "Midwesterners are more conservative. They don't take risks. They rarely do ARMs and they're good about paying back what they owe."

As a result of the conservatism, the housing market never boomed in the way it did in California and Nevada, which still have the highest rate of foreclosures anywhere in the country, along with Florida and Arizona.

That means the foreclosure rate in Sioux Falls is still a paltry 1 in 492 homes -- compared to Las Vegas' 1 in 20. But that's still a nearly 120% increase over last quarter. And since few bad mortgage loans were written, much of that jump is attributed to the unemployment rate rising to 4.6%.

But Oyen expects foreclosures to stabilize soon since the economy has remained relatively stable. The unemployment rate is miniscule compared to the national average of 9.8% and that of other foreclosure-wracked cities.

More galleries

Increase is between the second and third quarters of 2009.