Unlike the other states profiled here, Utah levies all the usual taxes, including corporate and personal income tariffs. But Utah's tax rates are relatively low compared to the national averages, which landed Utah in the #10 spot this year on the Tax Foundation's ranking of state business tax climates.

Utah gained points for its transparent and simple tax code. In 2008, Utah adopted a flat personal income tax rate of 5% across all brackets. The corporate income tax is also a flat 5%.

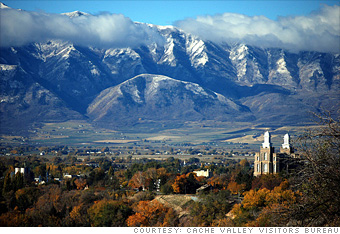

Still, local entrepreneurs would prefer to turn even less of their paychecks over to the government. "Utah is a pretty conservative state, and most people still think they are taxed too much," says Bert Israelsen, COO of Frontier Scientific, a company in Logan, Utah, that makes products for biomedical research.

Israelsen knows a few people that have hopped the border and moved to nearby Idaho to take advantage of lower taxes on property and vehicles. But Utah tax burdens are still a far cry from those endured by businesses in notoriously high-tax states like New York and California. "People are never happy with taxes, but in comparison with other states we are probably in good shape," says Israelsen.

The recession has taken its toll on government coffers. "Property tax revenues have held relatively steady, but if we are talking about sales tax, those are down significantly," says Rich Anderson, finance director for the city of Logan. "We've been trending 15% to 16% down from the prior fiscal year. It might be less than some places, but it's a pretty significant drop for us. Sales tax revenue is our main source of revenue."

But Utah residents don't need to worry that local governments will make up for tax shortfalls with sudden hikes. Thanks to a "Truth in Taxation" law passed in 1985, no taxing entity can increase its tax revenue -- not rate, revenue -- above what was collected in the previous year without holding a public hearing to explain the change. -Catherine Clifford and Kathleen O'Connor

More galleries