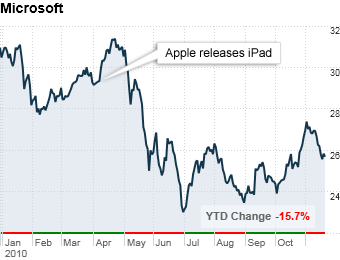

If you bought an iPad, you probably contributed to Microsoft's carnage this year. PC sales are moving at a snail's pace, and unlike Apple, Microsoft is struggling with its tablet strategy.

"We all know about the success the iPad has had so far, and it's starting to cannibalize PC sales, but to what magnitude remains to be seen," said David Hilal, analyst at FBR Capital Markets.

The company hasn't had much success in the mobile field yet either. But CEO Steve Ballmer says the company, which launched Windows Phone 7 last month, is still early to the market and has "nailed it." Analysts aren't so sure.

"It seems like a last-ditch effort to get into the mobile market," Hilal said. "They're coming from way behind and going up against the iPhone and Google's Android-based phones like the Droid, which are pretty successful."

But Harris Associates analyst Kurt Funderburg said the company may surprise consumers and shareholders.

"The value that the market is putting on Microsoft doesn't reflect the underlying strength of its business," Funderburg said. "All the negative scenarios out there are fully priced into the stock, and fail to account for any positives the company has ahead of it."

He added that businesses are still in the middle of their PC refresh cycles and even modest success for Windows Mobile 7 will boost the stock.

With shares as cheap as they are and the potential for surprise, Funderburg has a "very positive" outlook for the stock.

FBR's Hilal warns that stocks don't move higher for long just because they're cheap. Investors need to be confident in business fundamentals for shares to have adequate support.

The one business line Funderburg and Hilal agree could be a hot play for Microsoft is its cloud computing platform "Azure." It aims to help businesses save money by moving existing applications built on Microsoft's platform onto remote servers that are supported and serviced by Microsoft.

"Azure has been brewing for a while, and it has the best odds to be successful. But this won't happen for a while, so it won't move the needle on Microsoft's stock any time soon," said Hilal, who expects shares to remain in a tight range for some time.

NEXT: Bank of America: It's a keeper