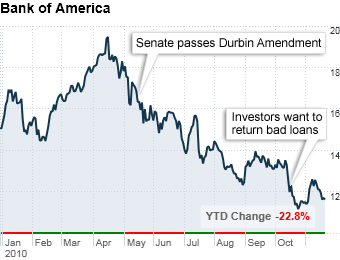

Bank of America shares have come under intense pressure as investors fret that the lender will be forced to buy back problem loans sold during the housing crisis to Fannie Mae and Freddie Mac as well as private investors.

Last week, the Congressional Oversight Panel warned that the four biggest banks involved in the housing mess could face losses upwards of $52 billion.

"There's an overhang on Bank of America's stock because it has sizable exposure to the issue, and investors are being cautious," said Blake Howells, vice president at Becker Capital Management. "It's unclear whether these liabilities are just headlines and earnings risk, or if they will bully Bank of America into having to go out to raise more capital.

Howells' firm continues to own shares of Bank of America, but it is a small position, accounting for less than 1% of Becker's assets.

"We know this will be a long drawn out battle in the courts, but that gives the bank time to establish larger reserves if they need and absorb the hits as they come," Howells said. "We think risks are already pretty well priced in the stock. As long as you're willing to stomach the headline risks and the volatility in the stock, there may be an opportunity to double your money over the course of a few years."

Morgan Stanley analyst Betsy Graseck recently noted that Bank of America shares are now cheap and particularly attractive after a judge dismissed $352 billion worth of claims against the bank earlier this month.

She said the market is missing the fact that the ruling suggests that the plaintiffs won't be able to make much of a case.

Investors have also sold off shares of Bank of America as they await clarity on how the Durbin Amendment, a provision in the Wall Street reform bill that will curb the fees banks can charge on debit card swipes, will impact the bank's balance sheet.

NEXT: Cisco: It's a keeper