The 6 biggest investing mistakes

Burton G. Malkiel, Princeton economics professor and author of 'A Random Walk Down Wall Street,' and Charles D. Ellis, author of 'Winning the Loser's Game,' have teamed up to write 'The Elements of Investing.'

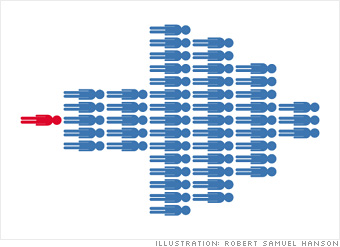

But any investment that has become a widespread topic of conversation among friends or has been hyped by the media is very likely to be unsuccessful. Throughout history, some of the worst investment mistakes have been made by people who have been swept up in a speculative bubble. Whether with tulip bulbs in Holland during the 1630s, real estate in Japan during the 1980s, or Internet stocks in the United States during the late 1990s, following the herd - believing that "this time it's different" - has led people to make some of the worst investment mistakes.

Just as contagious euphoria leads investors to take greater and greater risks, the same self-destructive behavior leads many to sell at the market's bottom when pessimism is rampant.

More money went into equity mutual funds during the fourth quarter of 1999 and the first quarter of 2000 - the top of the market - than ever before. Most of that money went to high-tech and Internet investments, the ones that turned out to be the most overpriced and then declined the most during the subsequent bear market. And more money went out of the market during the third quarter of 2002 than ever before, as mutual funds were redeemed or liquidated - just at the market trough. Later, during the punishing bear market of 2007-09, new record withdrawals were made by investors who threw in the towel at record lows just before the first, and often best, part of a market recovery.

It's not today's price or even next year's price that matters; it's the price you'll get when you sell. For most investors, that's in retirement - and even at age 60, chances are you will live another 25 years and your spouse may live several years more. So don't let the crowd trick you into either exuberance or distress. Remember the ancient counsel, "This too shall pass."

NEXT: Mistake #3: Timing the market