I worked as a VP of marketing and product development for a Fortune 500 company, and I loved my job. But in mid-2005 the company was acquired. I was 59 and was offered a good retirement package, and I took it.

I had done some investing and, in the recession, my retirement planner advised me to pull out some of my more aggressive investments in money markets and stocks, and safe-haven my portfolio instead. We also downsized to a smaller house.

My accountant and I talked it over and we figured it out: If I took early Social Security at 62, I would have to reach 76 or 77 to break even [and get less benefits over a lifetime than if I'd waited to get] full benefits at 66.

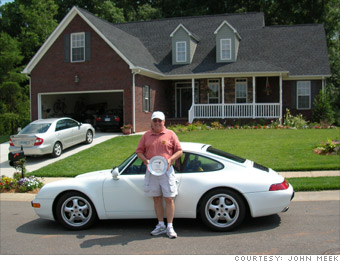

I did it, and I'm glad I did because those two -- the pension and Social Security -- gave me the base I needed, and I still do a little work on the side. I work as an instructor teaching high performance driving on race tracks.

Thankfully, I haven't had to go into any of my savings for these past 5 years.

NEXT: Paul Henderson, 62