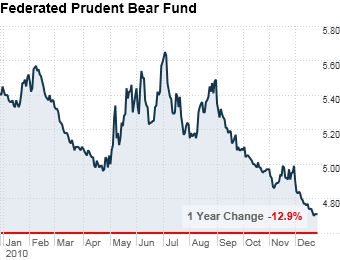

Owning a bear fund can be a dangerous pursuit: while your manager shorts stocks and waits for a crash, the market may rise enough to make you quit while you're down. But with Federated's Prudent Bear Fund, at least you know you should earn a solid return while you wait: it's returned an average 4.2% a year over the last decade, including a 27% return in 2008.

Manager Doug Noland calls the fund a core defensive position for any market cycle, and uses short-selling as well as investments in gold and precious metals to protect against what he sees as a long downward cycle in U.S. stocks. As of September, Noland had loaded the fund with short positions in information technology, healthcare, and consumer discretionary stocks.

NEXT: Select only high quality stocks