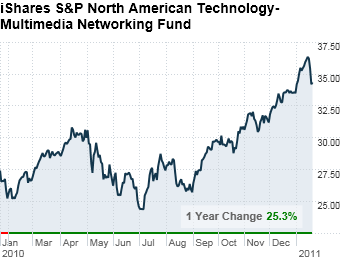

"Companies hadn't been investing in technology for the past few years, but now they're playing catch up," said Bill Witherell, chief global economist at Cumberland Advisors. He recommends investors buy a stake in BlackRock's iShares S&P North American Technology-Multimedia Networking Fund (IGN), which holds companies such as Cisco Systems (CSCO), Qualcomm (QCOM), and BlackBerry-maker Research in Motion (RIMM).

Witherell is also optimistic about energy companies, which are likely to benefit from higher oil prices, and the financial industry, which has been improving after enduring a brutal beating during the recession.

He recommends State Street Global Advisors' Energy Select Sector SPDR Fund (XLE), which tracks energy companies in the S&P 500 such as Exxon Mobil (XOM) and Chevron (CVX). On the financial sector front, he likes the Financial Select Sector SPDR Fund (XLF), which tracks financial companies such as JPMorgan Chase (JPM), Wells Fargo (WFC) and Berkshire Hathaway (BRKB).

Don't buy: Since the economy is in the midst of a recovery and the government is determined to keep it that way, avoid the defensive areas of the market, like utilities, consumer staples and health care, said David Kastner, market strategist at Charles Schwab Investment Advisory. Those sectors are typically used to protect portfolios during rough economic times.

Kastner advises skipping ETFs like State Street Global Advisors' Health Care SPDR (XLV), BlackRock's iShares S&P Global Consumer Staples (KXI) and BlackRock's iShares Dow Jones US Utilities (IDU).

NEXT: Region-specific funds