When the S&P hits the skids, the last person you want managing your money is some newly-minted MBA. So make sure you own funds led by managers who have not only delivered solid long-term returns but also lost less than most of their peers during down cycles.

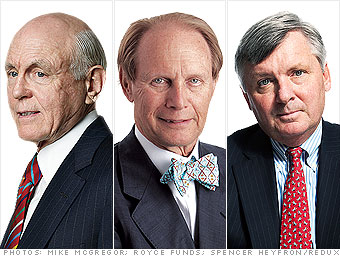

Richard Aster, Meridian Growth (

MERDX)

Start date: 1984

Focus: Midcap stocks

10-year return: 9.2%

Top 5% of category

Expense ratio: 0.81%

2008 loss: -30.4%; top 2% of peers

Charles Royce, Royce Pennsylvania Mutual (

PENNX)

Start date: 1972

Focus: Small-cap stocks

10-year return: 9.02%

Top 14% of category

Expense ratio: 0.9%

2008 loss: -34.87%; top 41% of peers

Brian Rogers, T. Rowe Price Equity Income (

PRFDX)

Start date: 1985

Focus: Large value stocks

10-year return: 4.4%

Top 28% of category

Expense ratio: 0.68%

2008 loss: -35.8%; top 39% of peers

NEXT: Guard against tax hikes with an IRA

By Carolyn Bigda, Beth Braverman, Veronica Crews, Ismat Sarah Mangla, Peter Valdes-Dapena and Penelope Wang - Last updated October 18 2011: 5:42 PM ET