Search News

We're no longer maintaining this page.

For the latest business news and markets data, please visit CNN Business

If investors had followed the advice made by top hedge fund managers at last year's Value Investing Congress, they would have would have seen big returns. This year's conference will be held Oct. 1-2.

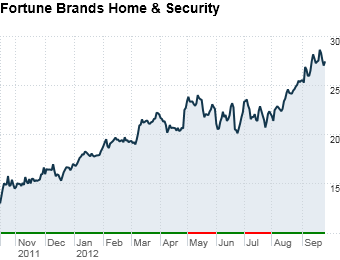

One of Ackman's deputies, partner Ali Namvar, presented Fortune Brands Home & Security (FBHS) as Pershing Square's top investing pick at last year's Value Investing Congress. If housing inked even a modest recovery, the company, which makes faucets, windows, kitchen and bathroom cabinets, would stand to benefit, said Namvar

Pershing Square had held an 11% stake in the company's parent, Fortune Brands, since 2010. By the end of that year, Fortune Brands' board succumbed to Ackman's pressure to split its business into three units: the home products division, the Beam (BEAM) liquor business, and its Titleist division.

Around the time of the 2011 conference, Pershing Square held an 18% stake in Fortune Brands Home & Security, but this year, the hedge fund exited the entire position.

Also at last year's conference, Ackman took the stage to defend his investment in J.C. Penney (JCP). He threw his support behind J.C. Penney's new CEO, Ron Johnson, who had previously been Apple's head of retail. Ackman said Johnson would help J.C. Penney redefine the shopping experience for consumers, much like he did with Apple (AAPL).

Investors following Ackman's lead there would have been taken on a wild ride. The stock soared for several months, moving up as much as 44% by February. Yet as the company's sales have fallen off a cliff, J.C. Penney's stock lost all those gains and then some. It's now down 19% from last October.