|

|

|

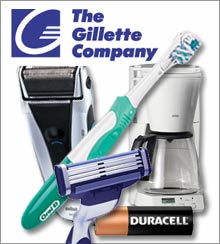

| Procter & Gamble's big names... |

|

|

|

|

| ... should be a good fit with Gillette's brands. |

|

|

|

NEW YORK (CNN/Money) -

Procter & Gamble announced the largest acquisition in its history Friday, agreeing to buy Gillette in a $57 billion deal that combines some of the world's top brands and could lead to further mergers involving products consumers know and love.

Procter & Gamble (Research) is already the nation's largest consumer products company, making everything from Pampers to Tide, from Crest toothpaste to Head & Shoulders shampoo. Products from Gillette (Research) include not only its signature razors but also Duracell batteries and Braun and Oral-B brands dental care products.

"This merger is going to create the greatest consumer products company in the world," said billionaire investor Warren Buffett, whose Berkshire Hathaway (Research) is Gillette's largest shareholder with 96 million shares, or about 9 percent of the company.

"It's a dream deal," Buffett said, adding that he would increase his holdings so that he would end up with 100 million shares of P&G by the time the deal closes. (The deal gives Buffett a one-day profit, on paper, of roughly $645 million and a whopping $4.4 billion profit overall. For more, click here).

The deal would give the company even more control over shelf space at the nation's retailers and grocers, real estate that is at a premium.

"Shelf space is diamond-encrusted gold. It's exposure to the consumer and everyone wants exposure to the consumer," said retail analyst Kurt Barnard. "They each had a lot of economic power before, but with the marriage they'll have a lot more power, power to get shelf space, preferred positions, all of that."

That increased power for the largest player in the U.S. industry is also seen as putting pressure on smaller rivals to eye deals of their own.

While P&G and Gillette officials didn't specifically address what other deals this one could spur, Gillette CEO Jim Kilts said he does expect further consolidation in the consumer products industry.

"I believe the consumer product industry needs to consolidate," he told analysts. "I'd rather lead it than end up with the leftovers."

Under the deal announced early Friday, Procter & Gamble will pay 0.975 share of its common stock for each share of Gillette common stock. Based on Thursday closing prices, that would represent an 18 percent premium for Gillette shares.

The news sent P&G stock down about 2 percent while Gillette jumped about 12 percent in afternoon trading.

P&G tried to assure investors concerned about the dilution of their holdings by announcing it would spend $18 billion to $22 billion of P&G's common stock during the next 12 to 18 months. It said that repurchase program should be the equivalent as if the deal were structured as 60 percent stock and 40 percent cash.

Executives at the companies said they believe they'll both be able to grow faster together than separately, with P&G opening doors for Gillette in markets such as China and Japan while Gillette bringing P&G some product segments that are growing faster than the company's overall current portfolio of products.

Because of expectations from the deal, P&G raised the annual revenue growth outlook to 5 to 7 percent, rather than its earlier target of 4 to 6 percent.

Job cuts coming

The deal will mean about 6,000 job cuts, or about 4 percent of the combined work force of 140,000 employees. It said most of the cuts would come from eliminating management overlaps and consolidation of business support functions.

The current value of the planned cost savings should come to $14 billion to $16 billion, according to the company's statement. P&G CFO Clay Daley said the companies expect to see more than $1 billion a year in cost savings by the third year after the merger.

He also said that some of the staff cuts will come from the P&G side of combination, not just the Gillette side.

P&G has 16 products that have sales of more than $1 billion each, and Gillette has another five, and with the companies' expanded rosters of must-have brands, they will have great leverage in negotiation with retailers for the all-important display space.

It also will allow them to get further savings from broadcasters and other media companies on advertising purchases. P&G is already the nation's largest television advertiser, while Gillette spends almost $1 billion a year on ads, primarily targeting men rather than P&G's traditional female customer.

One stock that fell in early European trading Friday morning on the news of the deal was Walt Disney Co. (Research), owner of both ABC and the male-oriented sports networks of ESPN.

Daley said the combined company should also see savings from manufacturing as well as the logistics of moving productions from plants to stores. And basic corporate administrative costs also are ripe for savings.

Executives at the two companies insisted the deal will also mean new product development for their customers. They said increased scale from the combination should help improve margins, which in turn should allow additional investment in research and development.

"This will enable us to continue to set the pace of innovation," said P&G CEO A.G. Lafley. "You either fund innovation or you become more like a commodity over time."

|