|

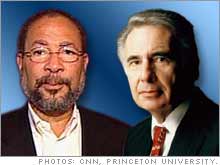

| Time Warner Chairman Richard Parsons, left, and financier Carl Icahn. |

|

|

|

NEW YORK (CNN/Money) -

Time Warner Inc. said Wednesday it's increasing its planned share buyback to $12.5 billion, responding to demands of financier Carl Icahn.

The world's largest media company had previously announced a $5 billion repurchase program. But Icahn, who leads a group of investors who own 2.6 percent of its shares, has been pushing for a $20 billion repurchase program in order to lift share prices.

Shares of Time Warner (Research) stock rose about 2 percent in pre-market trading on Inet following the announcement. But even with the bump shares are still down nearly 8 percent since the start of the year.

The company made the repurchase announcement as part of its third-quarter earnings report. Profits at the Time Warner rose about 80 percent, topping forecasts of analysts by 2 cents a share.

"Our solid third-quarter results and expanded stock repurchase program highlight the fundamental operating strength of our businesses and their growing momentum," said a statement from Time Warner Chairman and CEO Dick Parsons. "With our strong balance sheet, industry-leading free cash flow and solid earnings, we can expand our stock buyback while still having the resources to invest meaningfully in future growth as well as to pay our regular quarterly cash dividend."

Icahn and his group is also urging the company to sell its entire Time Warner Cable unit, and to place new members on Time Warner's board. The company has announced plans to sell a minority stake in Time Warner Cable, the nation's No. 2 cable operator behind Comcast, through an initial public offering, but Parsons has said the company is committed to staying in the cable business.

The cable unit saw the strongest gains in revenue among the five divisions at Time Warner, with revenue up nearly 13 percent in the quarter and 11 percent year to date. Operating profit was up 17 percent in the quarter and 13 percent year-to-date, the second best gain in earnings so far this year behind a 22 percent rise in profits at the America Online unit.

"Especially impressive were Time Warner Cable's results, driven by strong subscriber trends across its high-speed data, digital phone and digital video product lines," said Parson's statement, which did not directly address Icahn's demand to sell the unit. "In the fourth quarter, we'll continue to extend the competitive advantages of our cable company and our other businesses to fuel growth in 2006 and beyond."

CNN/Money is a unit of Time Warner.

|