GE may bring bad things to stocks

Disappointing earnings from corporate bellwether raises new worries about financial sector, takes stock futures sharply lower.

NEW YORK (CNNMoney.com) -- Stocks were set to tumble at Friday's open as corporate bellwether General Electric posted disappointing results that raised new worries about problems in the nation's financial sector.

Stock futures were pointing to a lower open for U.S. markets. They had been pointing higher before the shocking report from GE (GE, Fortune 500) at 6:30 a.m. ET sent them tumbling.

GE, which rarely posts results far from forecasts, earned only 44 cents a share from continuing operations, well below the 51 cents a share forecast by analysts surveyed by earnings tracker Thomson First Call.

The conglomerate pointed to disappointing results from its financial services business. It also gave second-quarter earnings guidance well below forecasts and trimmed its full-year earnings outlook.

Shares of Dow component GE tumbled nearly 6% in trading in Frankfurt immediately after the report.

In other corporate news, the pilots union at Delta Air Lines (DAL, Fortune 500) agreed to contract revisions that could clear the way for the No. 3 airline's merger with Northwest Airlines (NWAC), a combination that has been widely anticipated since January.

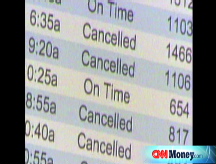

But there is also trouble in the airline industry. AMR (AMR, Fortune 500) unit American Airlines, the world's largest airline, canceled another 570 flights Friday as it tries to complete inspections of its MD-80 aircraft ordered by federal safety regulators.

And Denver-based low-fare carrier Frontier Airlines Holdings (FRNT) filed for Chapter 11 bankruptcy protection after it said its principal credit card processor started withholding "significant proceeds" received from the sale of Frontier tickets.

Retailer Linens 'n Things, the No. 2 home-furnishing store after Bed Bath & Beyond (BBBY, Fortune 500), could soon be the latest victim of the downturn in housing. The Wall Street Journal reported the privately held chain is set to file for Chapter 11 bankruptcy-court protection by Tuesday.

Biotechnology giant Genentech (DNA) reported improved first-quarter profit after the closing bell Thursday, although sales of its top-selling cancer drug disappointed Wall Street analysts.

Oil prices rose in early trading, as the May futures for a barrel of light sweet crude gained 48 cents to $110.59 in electronic trading.

In overseas trading, Japan's Nikkei led most Asian markets higher, although those markets closed ahead of the results from GE. Markets in Europe, which had been up in early trading, tumbled into negative territory along with U.S. futures after the GE report.

Just after the market opens Friday the University of Michigan will release its early survey results on consumer confidence in April. Economists are forecasting that index will fall to 69 from 69.5 in its previous reading. ![]()