|

Special report: | |

| Gas Crunch | ||

Oil, gas set new records

Crude futures jump after a refinery strike disrupts supply to U.K., retail gas hits another record.

NEW YORK (CNNMoney.com) -- Oil and gasoline prices continue to soar Monday as worker strikes, political turmoil, and speculation of a rate cut by the Federal Reserve rocked a market that does not need much of an excuse to trade higher.

Light, sweet crude oil for June delivery rose 23 cents from Friday's close, to settle at $118.75 a barrel on the New York Mercantile Exchange early Monday. Earlier Monday morning, crude reached an intra-day trading record of $119.93.

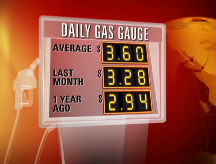

Gasoline hit a record $3.603 a gallon Monday, up four-tenths of a cent from the previous day, according to motorist group AAA. Monday's record was the 14th-consecutive record high for motor oil, despite continued weak demand.

BP workers walked out of a British refinery Monday, closing a refinery that delivers about one-third of England's oil from the North Sea. Though BP said its pipeline could be up and running when the strike ends Tuesday, the refinery may not return to full production until next week.

"This is a significant event," said Stephen Schork, publisher of the oil trading newsletter The Schork Report. "The consumer market in Great Britain is going to have to get their oil elsewhere, which is going to affect the global market."

In Nigeria, political upheaval continues to hamper the country's oil production. Rebels struck a Royal Dutch Shell pipeline Monday, the fourth pipe attacked in a week.

Oil traders are also closely watching the Federal Reserve's policy meeting on Tuesday and Wednesday. Most economists have forecast a quarter of a percentage point cut to its key funds rate, which has helped to boost oil prices lately. Though the central bank cuts interest rates to boost the economy, rate cuts are also inflationary, weakening the dollar and sending oil prices higher.

Investors tend to buy oil futures as a hedge against a declining U.S. currency. Also, oil is priced in dollars worldwide, so a falling dollar provides less incentive for oil-exporting countries to increase output, or for foreign consumers to cut back on oil use.

But many economists are also predicting the Fed will announce it will keep rates steady, or even raise rates in future meetings, to protect against inflation. That announcement may send crude prices lower.

"There is a very strong correlation between the dollar and crude, so it all depends on how [the] dollar reacts to the news," said Schork. "If the dollar appreciates, then that will give crude leeway to move downward." ![]()