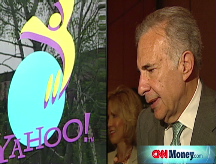

Yahoo puts Icahn on board, settling spat

Internet giant to expand board to 11 members, will give seat to Icahn and 2 others.

NEW YORK (CNNMoney.com) -- Yahoo said Monday it will add Carl Icahn to its board as part of a deal reached with the activist investor over the online giant's line-up of candidates for board of directors.

The Internet firm said it will expand its board from 9 members to 11, one of whom will be Icahn.

Under the deal, eight members of the current board of directors will stand for re-election - including Yahoo CEO and co-founder Jerry Yang and chairman Roy Bostock. Robert Kotick, CEO of Activision Blizzard (ATVID), will not stand for re-election.

Icahn will appoint the two other seats on the board. But he failed to attain broader control of the board.

Yahoo shares fell nearly 3% in morning trading.

The settlement ends a bitter proxy fight for control of the company. Icahn, who bought into Yahoo earlier this year, advocates the Internet giant selling itself to competitor Microsoft (MSFT, Fortune 500).

Mark May, analyst for Needham & Co., called the settlement "the next best solution for Icahn."

"Icahn has invested quite a bit of money in the stock and has gotten his friends and partners in the stock, but it became very clear last week that he was not going to be successful in his proxy battle," said May.

Even though Icahn failed to overthrow the board, he succeeded in "at least having some presence on the board," said May.

Icahn, who has made a name on Wall Street as an activist shareholder, owns nearly 69 million shares, or nearly 5%, of Yahoo (YHOO, Fortune 500).

Yahoo rejected the latest takeover bid from Microsoft earlier this month. Icahn criticized the decision, sparking a sharp exchange between himself and Yahoo's management

In a July 17 letter to shareholders, Yang and Bostock decried Icahn as a recent investor with "a strong incentive to strike any deal with Microsoft that enables him to recover his investment and get his money back quickly."

Yahoo is scheduled to release its earnings on Tuesday. Second-quarter revenue is projected to grow 10% to nearly $1.4 billion, while earnings are expected to rise 4% to 11 cents a share, according to the consensus estimate of analysts provided by Thomson/First Call.

May does not own Yahoo shares and his firm does not conduct business with the company. ![]()