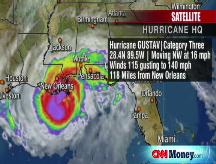

Oil drops as Gustav makes impact

Crude spikes then falls as hurricane bears down on region that is home to 25% of U.S. crude production and 56% of imports.

NEW YORK (CNNMoney.com) -- Hurricane Gustav slammed into the Gulf coast Monday morning, but oil prices fell as the world market expected that the storm's impact on the energy infrastructure would not be as serious as previously believed.f

Gustav, a Category 3 hurricane before it hit Louisiana mid-morning, was downgraded to a Category 2 storm prior to making landfall.

With the New York Mercantile Exchange closed for Labor Day, U.S. crude traded on global electronic markets down $4.60 at $110.86 a barrel.

"There was an expectation of a certain strength, but the storm hasn't been that strong," said Bob Tippee, editor of Oil & Gas Journal, an industry publication. "The sense now is that the storm isn't the monster that people thought it would be."

Still, traders won't get a sense Monday of the full impact of the storm, which may not be known for several days.

Gustav threatens oil imports and production facilities. The 5.6 million barrels of imported oil that enter the Gulf every day have been suspended, according to the U.S. Department of Energy. Those imports account for 56% of all oil imports, the agency said.

And the Gulf is the site of about 25% of U.S. oil production, or 1.3 million barrels a day. Offshore platforms and pipelines buried in the sea bed are vulnerable to extreme storms such as hurricanes.

The Energy Department said there are 22 natural gas plants along the Gulf of Mexico processing 13.2 billion cubic feet per day. Many of the plants have shut down due to Gustav.

As of Sunday evening, 96% of oil production in the Gulf has been halted, according to the Energy Department.

"As soon as a storm passes through, people have to go back to the facilities and check them for damage," said Tippee. "But unless there's much damage, production can start up again pretty quickly, and imports could come back almost immediately."

Since 2005, the industry began making improvements to the Gulf infrastructure. The Interior Department in April 2008 imposed more stringent design and assessment criteria for both new and existing structures located within particular Gulf of Mexico areas.

And pipelines, which carry most of the oil and gas from the production platforms to the shore, now are equipped with redundant electric generation stations to ensure the power to the pumps will not be interrupted.

"The industry learned a lot from 2005," said Tippee. "There is a sense that the damage will be much less this time."

Prices rose as high as $118.60 on Sunday in anticipation of a strong blow to the oil industry. However, the market's early reaction was much less frantic than it was in August 2005, when the impact of Hurricane Katrina sent oil prices up about $3, spiking just below $70 to a then-record $69.81 a barrel. With oil trading at nearly twice that amount today, a similar market reaction would have sent oil up about $5 to $121 a barrel.

"It seems like the market is weathering the storm, so the market's focus will shift back to soft demand and a stronger dollar," said Phil Flynn, senior market analyst with Alaron Trading. "Though Gustav will still do some damage, there's a real possibility that oil has more room to fall."

Though traders sense that the damage to offshore oil production facilities may be less than originally forecast, it remains to be seen whether onshore coastal oil refineries will suffer.

There are 150 refineries in the United States, about a third of which are located in the Gulf Coast region. About 15% of total U.S. refining capacity has been shut down, including 9 closed refineries and several more with reduced output, according to Esa Ramasamy, director of market reporting for energy analysis group Platts.

"Refineries can take just a few days or as many as 10 days to restart," said Tippee. "If the refineries aren't damaged, the storm won't have as major an impact."

In a precautionary measure, the Energy Department said Thursday it was prepared to release supplies from the government's 700 million barrel Strategic Petroleum Reserve to cushion the blow. After Katrina and Rita, the government opened up the SPR for just the fourth time in history, shipping off just 11 million barrels to refiners.

But in a preliminary report Sunday, the department said existing supplies of oil may be enough to avoid major problems in the market.

"[A]bsent significant physical damage to the region's energy systems, the record level of supply existent in the SPR today, coupled with the inventories held both offshore and onshore by the petroleum sector, should ensure these disruptions are localized and temporary," the department wrote. ![]()