Obama urges higher deposit insurance

Democratic presidential candidate proposes raising FDIC limit from $100,000 to $250,000 in hope of gaining legislative support for $700B bailout.

|

| Obama said he will talk to members of Congress to present his ideas - and urge them to pass the $700B bailout plan. |

(CNN) -- Democratic presidential candidate Barack Obama Tuesday proposed expanding federal deposit insurance for families and small businesses as a way to convince lawmakers who voted against the $700 billion federal bailout plan to change their minds.

"One step we could take to potentially broaden support for the legislation and shore up our economy would be to expand federal deposit insurance for families and small businesses across America who have invested their money in our banks.

"The majority of American families should rest assured that the deposits they have in our banks are safe," Obama said in a statement put out by his presidential campaign.

"That is why today, I am proposing that we also raise the FDIC limit to $250,000 as part of the economic rescue package - a step that would boost small businesses, make our banking system more secure and help restore public confidence in our financial system."

Currently, deposits of up to $100,000 are guaranteed by the government's Federal Deposit Insurance Corporation.

Obama said he will talk to leaders and members of Congress later Tuesday to offer his idea and urge them to act without delay to pass a rescue plan.

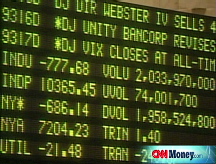

Monday, the House of Representatives - defying leaders of both parties, the White House and both presidential nominees - voted down the economic rescue plan by 228 to 205 margin.

The Illinois senator urged lawmakers to try again on the bailout proposal and warned of grave consequences if nothing is done.

"Continued inaction in the face of the gathering storm in our financial markets would be catastrophic for our economy and our families. At this moment, when the jobs, retirement savings and economic security of all Americans hang in the balance, it is imperative that all of us, Democrats and Republicans alike, come together to meet this crisis." ![]()