Audit: More oversight for $700B bailout

The Government Accountability Office, in a first official review of the bailout, wants Treasury to address 'critical' oversight issues of the financial rescue plan.

NEW YORK (CNNMoney.com) -- The first official review of the federal government's $700 billion financial rescue plan said Treasury has yet to address "critical" oversight issues to ensure the plan is working.

The Government Accountability Office's study, presented to Congress Tuesday, found that the Treasury program needs more staff, better management, an improved transition effort and facilities to ensure banks are using bailout funds effectively.

"Without effective oversight, Treasury cannot ensure that those receiving funds are complying with [the capital purchase program's] requirements," the report said.

The report called for a consistent process for monitoring participating institutions, so that Treasury can identify and address any potential compliance issues with banks receiving funds from the Troubled Asset Relief Program, or TARP.

The Treasury so far has injected $150 billion in capital into the financial system by buying preferred shares in 52 institutions. Treasury Secretary Henry Paulson said Monday that the department is reviewing hundreds of applications from banks seeking funding.

Treasury doled out the government money with the intention that banks use it to lend, but some have instead used bailout funds to finance purchases of other institutions. The program is meant to ensure the bailout funds do not go to finance paychecks of top executives, and banks are required to pay out a dividend.

But the report said Treasury currently lacks sufficient oversight methods to ensure banks comply.

"It's not at all surprising, that Treasury's still behind the 8-ball," said Bob Brusca, economist with FAO Economics. "How would you know if TARP funds go to pay for loan servicing or went to pay a CEO salary? Money doesn't have footprints."

GAO recommended that Treasury work with bank regulators to establish a "systematic" and transparent way to hold banks accountable for how they use bailout funds.

The report said Treasury should develop a method to ensure that banks' activities are consistent with TARP's goals. Furthermore, GAO said the program needs robust policies, procedures and guidance that protect taxpayers.

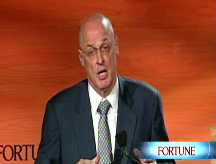

In response to the report, Neil Kashkari, the Treasury Department's interim point person for the bank bailout, said Treasury agreed with all of GAO's recommendations, except it disagreed on the methods of evaluating how banks are using TARP funds. He said Treasury is developing its own compliance programs for banks, but he did not say what was different about those programs from the report's recommendations.

In addition to oversight, GAO made several other recommendations to improve Treasury's program:

Improve communication: The report said communication about TARP should be "formalized," so that lawmakers and the public remain up-to-date on the program's strategy and actions "to avoid information gaps and surprises."

In mid-November, Paulson said Treasury would no longer buy up toxic assets from banks' balance sheets, surprising investors and banks alike. The announcement resulted in several days of rising borrowing costs and tumultuous stock trading.

The report did not question why Treasury changed its original game plan or whether it was using TARP for the best purpose.

"The report missed the forest through the trees," said said Edward E. Gainor, a lawyer at McKee Nelson in Washington. "There are valid questions to be raised, like why did they ignore so many basic goals of the legislation?"

Gainor, who represents funds pursuing distressed asset investments, said if the report was intended to serve as a roadmap for how Treasury is to proceed with TARP, "they could have focused more sharply on substance and less on procedure."

House Speaker Nancy Pelosi, D-Calif., called the GAO report "discouraging."

"The GAO report reaffirms Congress' view and calls on Treasury to take several critical steps to accomplish this goal, specifically by improving its communication with Congress and the general public," Pelosi said.

Presidential transition: GAO said Treasury must "facilitate a smooth transition" to the Obama administration. President-elect Barack Obama's nomination of New York Fed President Timothy Geithner was praised by economists, who applauded the selection of an insider who would allow for a seamless handover.

The report said Treasury should formalize its bailout activities to make for an even smoother transition.

Hire more staff: The report said the government must hire more personnel to and train them appropriately. A common criticism of the program is that it is inadequately staffed, making oversight difficult.

"When Paulson first announced the plan, he had an idea that was based on a program that was never tried," Brusca said. "They had to put a staff together quickly."

Mitigate conflicts of interest: Treasury relies heavily on private sector third-party personnel to help oversee the program, which could result in conflicts of interest, especially if the industry staff's parent companies are in receipt of bailout funds. GAO recommended that the Treasury set up provisions to monitor those potential conflicts.

Measures of success: The report said Treasury does not yet have an effective way to determine if the plan is working. GAO said measuring the impact of TARP on credit markets and the broad economy will be challenging, because economic conditions are deteriorating.

Still, the study identified some indicators that will show whether TARP is working. Such measures include falling mortgage rates, higher mortgage volume and fewer foreclosures and home loan defaults. GAO also said narrowing corporate bond spreads and Libor-OIS and TED spreads, which measure investor confidence and banks' cash availability, will show credit markets are improving and the Treasury's efforts are successful.

The report is the first of a series of reports that the GAO must submit to lawmakers on a bi-monthly basis.

The office represents one of three oversight components required by the Emergency Economic Stability Act.

Even though the bailout bill was passed Oct. 3, the other two oversight bodies - a five-member congressional oversight panel and an inspector general - weren't named until mid-November.

President Bush nominated Neil Barofsky, a New York federal prosecutor, as EESA's inspector general. Despite bipartisan support for his nomination in the Senate Banking Committee, the nomination was blocked, and confirmation proceedings are expected to continue.

The congressional panel is made up of Harvard law professor Elizabeth Warren, New York state Superintendent of Banks Richard Neiman, AFL-CIO Associate General Counsel Damon Silvers and Rep. Jeb Hensarling, R-Texas.

A fifth member, Sen. Judd Gregg, R-N.H, stepped down Monday.

The panel is expected to produce a report on the status of the bailout by the end of the year. ![]()