Sovereign, EA to cut 2,000 jobs

Sovereign Bancorp and Electronic Arts each announce 1,000 job cuts.

NEW YORK (CNNMoney.com) -- Sovereign Bancorp and video-game designer Electronic Arts announced on Friday that they are cutting a total of 2,000 jobs, laying blame on the recession.

Sovereign (SOV, Fortune 500), based in Philadelphia, and EA (ERTS), based in Redwood City, Calif., both said they intend to cut 1,000 jobs.

EA spokesman Jeff Brown said the company will close nine facilities in addition to cutting 1,000 positions, or 10% of its workforce. The job cuts will take place across all divisions, said Brown.

"There's a high degree of economic uncertainty, and we're also not generating the revenue as forecast," said Brown, noting that the cuts will take place over the next three months. "We need to focus on making bigger bets on fewer games and cut costs accordingly."

EA said it plans to save $120 million annually from the restructuring, though the project will cost up to $65 million to implement.

EA has facilities in San Francisco, Los Angeles, Austin, Texas, and Orlando, Fla., as well as the Canadian cities of Montreal, Edmonton and Vancouver.

Sovereign said its job cuts will continue throughout 2009 and are necessary "to reduce costs and increase the bank's efficiency."

"The decision to reduce our workforce was a very difficult one, especially during the holiday season," Kirk Walters, chief financial officer and acting chief executive, said in a press release. "There is never a good time to reduce staff, but this step is necessary, particularly during this economic environment."

This 10% staff reduction is inclusive of the 6% cut that the company had announced on Oct. 30 in its quarterly earnings report.

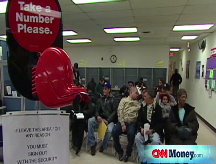

The U.S. economy lost nearly 2 million jobs in the first 11 months of this year, according to government figures. That includes 533,000 job cuts just in November, the worst monthly toll in 34 years.

The month of December has also been unforgiving, with about 140,000 job cuts announced so far. Bank of America (BAC, Fortune 500) announced a particularly harsh plan earlier this month, when it promised to slash up to 35,000 jobs over three years as it absorbs Merrill Lynch. ![]()