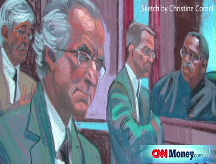

Madoff-linked GMAC chairman resigns

J. Ezra Merkin reportedly lost $1.8 billion fund he managed to the Madoff scheme.

NEW YORK (CNNMoney.com) -- GMAC chairman J. Ezra Merkin, who lost billions after getting caught up in the Madoff scandal, resigned from the finance company's board Friday.

During the transition to a new GMAC board the managing director and co-head of Cerberus Capital Management, Lenard Tessler, will replace Merkin, according to a GMAC statement.

Merkin ran two funds - the $5 billion Gabriel Partners and the $1.8 billion Ascot Partners and lost at least the entire Ascot fund to the Madoff scheme.

The vacant seat will be filled by Jeffrey Lomasky, Cerberus' chief financial officer. GMAC, which provides loans to auto dealers and customers is partially owned by Chrysler parent Cerberus and also by General Motors (GM, Fortune 500).

GMAC was permitted to become a bank holding company by the Federal Reserve and is participating in the Treasury Department's Troubled Asset Relief Program.

The board will be reconstituted no later than March 24.

According to the company, the seven-member board will be made up of GMAC chief executive Al de Molina, one representative from FIM Holdings LLC, two directors appointed by a trust to be formed the Treasury Department, and three independent directors elected by the board's directors.

Merkin is president of Manhattan's Fifth Avenue Synagogue and was a well-respected investor and one of the nation's leading Jewish community leaders.

Merkin is the second generation scion of a prominent banking family, and was until recently on the investment committee of Yeshiva University. Madoff was chairman of the business school.

Yeshiva University President Richard Joel announced on December 16th that the school had lost about $110 million of its endowment funds to Madoff. Yeshiva apparently had no conflict-of-interest rule barring investments with a board member

On Dec. 31, GMAC announced the results of a vote that the company said would help it become better capitalized and viable for the future.

GMAC announced that holders of $21.2 billion of its debt agreed to a plan to swap their bonds for about $15.7 billion in stock and cash. A total of 59% of GMAC debt holders and 39% of its Residential Capital division investors made the switch.

GMAC has been trying to raise capital after the Federal Reserve said the in late December that it would approve GMAC's conversion to a bank holding company.

The company said it hoped the exchange program would help it meet the Fed's bank capitalization requirements, which would make it have $30 billion of capital on hand.

But the Fed said it made a special exception for GMAC, as the government considers the company critical to the recovery of the U.S. auto industry.

GMAC is trying to recover from $7.9 billion of losses in the previous five quarters, most of which came from risky subprime mortgage bets made by ResCap. It got some help Dec. 29 when the Treasury Department invested $6 billion in the company through the Troubled Asset Relief Program.

Treasury confirmed Dec. 31 that it had finalized the loan transaction and funded the first $4 billion in federal loans to General Motors.

In December, the government announced plans to make a total of $13.4 billion in loans available to GM and Chrysler. As a condition of the loan, GM submitted a "viability plan" to Congress, which it agreed to implement in order to secure the funds.

In a statement Dec. 31, the company said it is committed to successfully executing its viability plan, and is "confident in the future of General Motors."

Jennifer Reingold and David Goldman contributed to this report. ![]()