Bond prices fall as Obama takes over

Treasury prices decline, especially longer-term maturities, as the nation watches the next president take office and the market readies for new issues.

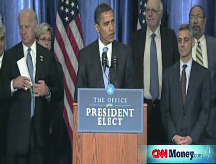

NEW YORK (CNNMoney.com) -- Government debt prices fell Tuesday as Barack Obama was sworn in as the nation's 44th president, with the struggling economy - and government efforts to revive it - serving as a backdrop.

President Obama has pledged to rescue the U.S. economy, which has been mired in recession since December 2007. So far, his plans have included a lot of spending, which the government will finance by selling Treasurys.

With the government deficit already exceeding $1 trillion, the rescue plan that Obama has been touting means that the government will be auctioning off a tremendous volume of debt. The onslaught of debt headed to market puts a damper on government bond prices.

"Even though there is still tremendous risk aversion in the market, supply concerns are starting to outweigh" the desire to keep assets in the safe haven of government bonds, said Kim Rupert, fixed-income analyst at Action Economics.

Sinking bond prices are "a reflection of the massive stimulus plan in effect and the likelihood that there is more coming down the road, and the concerns how we will pay for all of this," said Rupert.

Obama's team and House Democrats came up with an $825 billion rescue package, called the American Recovery and Reinvestment bill, which attempts to save and create between 3 million and 4 million jobs by 2010.

"We know that the Congress wants to get the stimulus package through as soon as possible after he gets inaugurated so it brings the issue of debt [volume] really to the forefront," said Mary Ann Hurley, vice president of fixed-income trading at D.A. Davidson.

The Obama team has promised to overhaul the current structure of the Troubled Asset Relief Program, or TARP. The $700 billion bailout plan the Bush administration passed may be restructured to remove toxic debt from banks and put it in a centralized "bad bank," allowing the financial sector to return to health.

"Another reorganization of TARP isn't doing a lot for confidence," said Rupert. "It is a really difficult trading environment right now." With the level of uncertainty in the marketplace still very high, Rupert said some investors may be preferring to sit on the sidelines with their cash.

Obama's administration still has $350 billion of the bailout fund to spend. "It is not a question of is it going to be spent, it is just a question of how," said Hurley. "And that is deficit financing," she added.

With the banking sector steeped in turmoil, the government has been stepping in repeatedly to try to prop up the industry. But with bank stocks - including Citigroup (C, Fortune 500) and Bank of America (BAC, Fortune 500) - falling Tuesday, investors started to wonder if the government would need to contribute even more capital to the banks, according to William Larkin, portfolio manager at Cabot Money Management.

"We are talking huge amounts of capital," said Larkin, and in order to raise the capital to keep the banks healthy, the government will have to issue more debt, but Treasury prices have been high, so investors are wondering if there will be demand at these expensive prices.

Bond prices were lower Tuesday because of "two realizations coming to fruition at exactly the same time," said Larkin. First, that there will be a need for additional stimulus. Secondly, "the current yields in the Treasury market are definitely in bubble territory," he said.

Debt coming to market: With yields low and prices of Treasurys high, the market was concerned about whether there would be enough demand going forward to buy up the debt coming to market. "A new risk to Treasurys is going to be anticipated future supply," said Larkin.

This week, the Treasury was set to auction off $119 billion worth of debt. On Tuesday, the government auctioned $27 billion worth of 26-week bills and $27 billion worth of 13-week bills. On Wednesday, the Treasury was set to auction $35 billion worth of cash management bills and $30 billion worth of 4-week bills.

Hurley said that as more and more government debt comes to market, there is concern as to whether there will be enough buyers for it. In particular, Hurley raised the question of foreign buyers leaving the market as the global economic downturn forces foreign investors to spend on their own domestic problems.

Foreign nations "have radically reduced their buying of items that are longer out on the curve because they have their own domestic issues and their own problems and they have other places to spend their money than buying our debt," said Hurley.

Debt prices: Government debt prices held in a tight range through the inauguration ceremony and as the office of the president officially transitioned to Barack Obama. Treasury prices were lower through the session, but lifted slightly off earlier lows as the afternoon continued and as the sell off in the stock market accelerated.

The benchmark 10-year Treasury note fell 1 19/32 to 111 30/32 and its yield rose to 2.38% from 2.34% late Friday. Bond prices and yields move in opposite directions.

The Treasury market was closed Monday in observance of Martin Luther King, Jr. Day.

The 30-year bond sank 2 10/32 to 129 30/32 and its yield rose to 2.97% from 2.91% late Friday.

Meanwhile, the 2-year note held steady at 100 10/32 and yielded 0.72%.

The yield on the 3-month bill held steady at 0.12%, even with Friday. The 3-month bill has been used as a gauge of confidence in the marketplace because investors tend to shuffle funds in and out of the bill as they asses risk in other places.

Lending rates: The 3-month Libor rate ticked lower to 1.12% from 1.13% Monday, according to data available on Bloomberg.com. The overnight lending rate continued to hold steady at 0.14%.

Libor, the London Interbank Offered Rate, is a daily average of rates 16 different banks charge each other to lend money in London, and it is used to calculate adjustable-rate mortgages. More than $350 billion in assets are tied to Libor.

Two credit market gauges showed slightly increased confidence.

The so-called "TED" spread, a measure of banks' willingness to lend, narrowed to 1.00 percentage point from 1.04 percentage points Monday. The lower the TED spread, the more willing investors are to take risks. The rate surged as the credit crisis gripped the economy, but has since fallen off as central banks around the world have lowered interest rates and pumped the economy with liquidity.

On Monday, for example, the British Treasury announced a second bank rescue plan, aimed at easing credit and increasing lending.

Another market indicator, the Libor-OIS spread, dipped to 0.93 percentage point from 0.94 percentage point Monday. The Libor-OIS spread measures how much cash is available for lending between banks, and is used for determining lending rates. The narrower the spread, the more cash is available for lending. ![]()