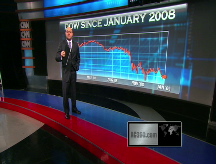

Stocks in early tumble

Wall Street extends its retreat on a new wave of weak economic reports.

NEW YORK (CNNMoney.com) -- Stocks slipped Monday morning, the first trading day in February, as a weaker-than-expected report on consumer spending and concerns about delays in the passage of an economic stimulus bill weighed on sentiment.

The Dow Jones industrial average (INDU) fell 92 points, or 1.1% in the early going. The Standard & Poor's 500 (SPX) index lost 11 points, or 1.3%. The Nasdaq composite (COMP) lost 12 points, or 0.8%.

The Dow and S&P 500 posted their worst January performance ever, and the outlook for February isn't much better. (Full story)

Economy: The government said that personal income slipped 0.2% in December, better than expectations of a 0.4% decline, from a consensus of economists surveyed by Briefing.com. Personal spending fell 1%, worse than the expected 0.9% decline.

That's followed by a key reading on nationwide manufacturing, which comes out at 10 a.m. ET. Figures on construction spending are also due to be released at that time.

But Art Hogan, chief market strategist at Jefferies & Co., said the most important economic report will come out Friday, when the Labor Department releases information on non-farm payrolls and the unemployment rate.

"Everything is going to be taking a back seat to the end of the week, when we get the labor numbers," said Hogan, adding that investors have abandoned the notion that bad news is "priced in" to the markets.

Politics: The Senate on Monday begins its debate over the proposed stimulus package. Potential amendments include lower mortgage rates, a foreclosure moratorium and an expansion of home buyer credit.

World markets: Worries about the outlook for corporate profits sent Asian shares lower. Japan's Nikkei lost 1.5% and the Hang Seng in Hong Kong tumbled 3%.

Stocks in Europe fell in afternoon trading, with France's CAC-40 and the DAX in Germany off over 2%. Britain's FTSE 100 tumbled 2.2% as heavy snowfall blanketed London, bringing most of the city to a halt.

Oil and money: Oil prices fell $1.25 to $40.43 a barrel on the New York Mercantile Exchange. The dollar fell against the yen, but rose versus the euro and the British pound. ![]()