Insiders sell like there's no tomorrow

Corporate officers and directors were buying stock when the market hit bottom. What does it say that they're selling now?

|

| Stocks have rallied -- but corporate officers and directors are now selling after buying the dip. |

NEW YORK (Fortune) -- Can hundreds of stock-selling insiders be wrong?

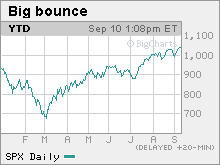

The stock market has mounted an historic rally since it hit a low in March. The S&P 500 is up 55%, as U.S. job losses have slowed and credit markets have stabilized.

But against that improving backdrop, one indicator has turned distinctly bearish: Corporate officers and directors have been selling shares at a pace last seen just before the onset of the subprime malaise two years ago.

While a wave of insider selling doesn't necessarily foretell a stock market downturn, it suggests that those with the first read on business trends don't believe current stock prices are justified by economic fundamentals.

"It's not a very complicated story," said Charles Biderman, who runs market research firm Trim Tabs. "Insiders know better than you and me. If prices are too high, they sell."

Biderman, who says there were $31 worth of insider stock sales in August for every $1 of insider buys, isn't the only one who has taken note. Ben Silverman, director of research at the InsiderScore.com web site that tracks trading action, said insiders are selling at their most aggressive clip since the summer of 2007.

Silverman said the "orgy of selling" is noteworthy because corporate insiders were aggressive buyers of the market's spring dip. The S&P 500 dropped as low as 666 in early March before the recent rally took it back above 1,000.

"That was a great call," Silverman said. "They were buying when prices were low, so it makes sense to look at what they're doing now that prices are higher."

In the case of firms such as discount broker TD Ameritrade (AMTD), they are selling with abandon. Chairman Joe Moglia has netted more than $10 million in profits from stock sales since April, by selling shares on each of the last 106 business days, according to Securities and Exchange Commission filings.

A TD Ameritrade spokeswoman said Moglia's sales are being made under a pre-arranged selling plan he filed with the SEC last August. Under that plan, his brokers exercise some options he got eight years ago and sell the underlying shares every day the company's stock price is above a certain level.

Moglia's not the only insider selling at TD Ameritrade. The company's founder and former chairman, Joe Ricketts, and his wife Marlene last month sold 5.7 million shares to help fund the family's purchase of the Chicago Cubs baseball team. They owned 16% of the company's stock at last count.

Silverman said the TD Ameritrade insider sales don't particularly raise concerns about the company's health, because "special circumstances" -- the Cubs deal and the pending expiration of Moglia's options -- are evident.

He said it's potentially more worrisome when insiders suddenly make big sales without obvious motivating factors.

Fossil (FOSL) CEO Tom Kartsotis has sold $25 million of the watchmaker's stock over the past month. Shares of Fossil have more than doubled since early March. Fossil didn't immediately return a call seeking comment.

At video game maker Activision Blizzard (ATVI), CEO Robert Kotick and director Brian Kelly each made more than $10 million last month by selling shares after exercising stock options.

While some of Kotick's options were due to expire next year, others weren't due to expire until 2014 in his case and 2012 in Kelly's. The stock sales took place at prices that were about 50% above their 52-week low. Activision didn't respond to a request for comment.

Adding to the flurry of stock sales, companies are selling stock to the public at a brisk clip while buybacks have tailed off. All told, U.S. corporations have been net sellers of $105 billion of stock over the past four months, Biderman said.

Insiders have managed to cash in on some of those offerings. Healthcare payment administrator Emdeon (EM), for instance, last month raised $155 million in an initial public offering. At the same time, selling shareholders led by private equity investor General Atlantic Partners raised $188 million.

Though the wave of selling by insiders doesn't necessarily predict a pullback in their stocks or the market as a whole, it's hard to put a happy spin on the recent trends.

"The disparity between buyers and sellers right now is vast," said Silverman. "That's the beauty of following insider trading -- these guys are talking with their checkbooks." ![]()